TL;DR

We relentlessly pursue self-improvement, career milestones, and our 'best lives,' yet often ignore the silent saboteurs that can dismantle it all Discover why strategic financial resilience – encompassing Family Income Benefit, Income Protection, Personal Sick Pay for tradespeople, nurses, and electricians, Life and Critical Illness Cover, and the often-overlooked benefits of Gift Inter Vivos and private health insurance (offering crucial access to faster, specialized care) – isn't just about safeguarding against 2025's stark health realities (like 1 in 2 UK adults facing cancer), but the essential, unshakeable foundation for truly sustainable personal growth and a protected future for your loved ones. (illustrative estimate) We live in an age of aspiration. We meticulously plan our careers, curate our social media feeds, invest in our education, and optimise our health with gym memberships and organic diets.

Key takeaways

- Income Halts: Your salary, the lifeblood of your financial world, can stop overnight.

- Bills Pile Up: Your mortgage, rent, council tax, and utility bills don't pause just because you're unwell.

- Savings Evaporate: The emergency fund you painstakingly built can be wiped out in months, not years.

- Dreams Are Derailed: Plans to start a business, move house, or fund your children's education are put on indefinite hold.

- Life Insurance (Life Protection): This is the most fundamental form of protection. It pays out a tax-free lump sum if you pass away during the policy term. Its purpose is simple: to provide for those you leave behind. This money can be used to:

We relentlessly pursue self-improvement, career milestones, and our 'best lives,' yet often ignore the silent saboteurs that can dismantle it all

Discover why strategic financial resilience – encompassing Family Income Benefit, Income Protection, Personal Sick Pay for tradespeople, nurses, and electricians, Life and Critical Illness Cover, and the often-overlooked benefits of Gift Inter Vivos and private health insurance (offering crucial access to faster, specialized care) – isn't just about safeguarding against 2025's stark health realities (like 1 in 2 UK adults facing cancer), but the essential, unshakeable foundation for truly sustainable personal growth and a protected future for your loved ones. (illustrative estimate)

We live in an age of aspiration. We meticulously plan our careers, curate our social media feeds, invest in our education, and optimise our health with gym memberships and organic diets. The narrative of modern life is one of perpetual growth – becoming better, stronger, wealthier, and happier. We build our lives like intricate structures, brick by brick, milestone by milestone.

Yet, what about the foundations? While we focus on the soaring architecture of our ambitions, we often neglect the unseen bedrock upon which everything rests. This bedrock is our financial resilience – our ability to withstand the unexpected shocks that life inevitably throws our way. A sudden illness, a serious accident, or an untimely death can act as a seismic event, not just causing emotional devastation but also threatening to bring our carefully constructed lives crashing down.

This isn't about scaremongering; it's about empowerment. True, sustainable personal growth isn't possible when you're walking a tightrope without a safety net. It's about having the freedom to take calculated risks, to pursue your passions, and to build a future for your family, knowing that a robust financial shield is in place. In this guide, we will explore the essential components of that shield, moving beyond basic insurance to a holistic strategy for a protected and prosperous future.

The Illusion of Control: Why Our 'Best Lives' Are More Fragile Than We Think

The pursuit of self-improvement gives us a powerful sense of agency. We track our macros, follow productivity gurus, and map out five-year plans. This creates an illusion of control, a belief that if we just work hard enough and make the right choices, we can engineer a perfect life.

The problem? Life is inherently unpredictable. You can’t schedule a sudden diagnosis or pencil in a debilitating injury. The financial consequences of such events can be swift and brutal:

- Income Halts: Your salary, the lifeblood of your financial world, can stop overnight.

- Bills Pile Up: Your mortgage, rent, council tax, and utility bills don't pause just because you're unwell.

- Savings Evaporate: The emergency fund you painstakingly built can be wiped out in months, not years.

- Dreams Are Derailed: Plans to start a business, move house, or fund your children's education are put on indefinite hold.

Consider the freelance web developer who has just landed their biggest client. They are the epitome of success – skilled, in-demand, and building a thriving business. But a non-work-related accident results in two broken wrists. Without an income for three months, they not only face immediate financial hardship but also risk losing their hard-won clients and career momentum. Their entire professional structure, built on their ability to type and code, proves terrifyingly fragile. This is where the concept of financial resilience moves from a theoretical 'nice-to-have' to an absolute necessity.

The Health of the Nation: A 2025 Snapshot of UK Risks

To understand why a financial safety net is so crucial, we must look at the real-world health challenges facing the UK population. These aren't abstract fears; they are statistical realities that affect millions of us.

1. The Cancer Reality The most sobering statistic comes from Cancer Research UK, which projects that 1 in 2 people in the UK born after 1960 will be diagnosed with some form of cancer during their lifetime. While medical advancements mean survival rates are continually improving, surviving a critical illness often comes with a significant financial cost. Treatment can mean long periods off work, and recovery can require lifestyle changes and even home modifications. (illustrative estimate)

2. Musculoskeletal (MSK) Conditions According to the Office for National Statistics (ONS), musculoskeletal issues, such as back and neck pain, are consistently one of the leading causes of sickness absence in the UK. In 2023, an estimated 28.2 million working days were lost due to these conditions. For tradespeople, nurses, and anyone in a physically demanding job, an MSK problem isn't just painful; it's a direct threat to their livelihood.

3. The Mental Health Crisis Mental health is finally being recognised as a major public health issue. ONS data reveals that depression, stress, and anxiety are another primary reason for long-term work absence. The pressures of modern life, career demands, and financial worries can create a vicious cycle, where stress leads to illness, which in turn leads to more financial stress.

4. NHS Waiting Lists The NHS is a national treasure, but it is under unprecedented strain. As of early 2025, waiting lists for routine treatments in England remain historically high, with millions of people waiting for appointments and procedures. The median wait time for non-urgent, consultant-led treatment can stretch for months. This isn't just an inconvenience; for someone in pain or unable to work, waiting for a diagnosis or surgery can mean months of lost income and declining quality of life.

Here is a simple breakdown of the risks versus the typical state support available:

| Risk Scenario | Potential Impact | Standard UK Support |

|---|---|---|

| Serious Illness (Cancer) | Unable to work for 12+ months. | Statutory Sick Pay (£116.75/week) for up to 28 weeks, then potential for Universal Credit. |

| Back Injury (Tradesperson) | Off work for 3-6 months. | Statutory Sick Pay (if employed) for up to 28 weeks. Nothing if self-employed. |

| Mental Health Burnout | Signed off work for 6 months. | Statutory Sick Pay for 28 weeks, then potential benefits assessment. |

| Need for Knee Surgery | Unable to perform job. | Placed on NHS waiting list (average wait time can be several months). |

The disparity is stark. The support systems in place are a basic safety net, but they are not designed to maintain your lifestyle, protect your home, or secure your family's future. That responsibility falls to you.

Your Financial Fortress: A Guide to Personal Protection Policies

Building your financial resilience involves strategically layering different types of protection to create a comprehensive shield. Each policy serves a unique purpose, protecting you and your loved ones from different "what if" scenarios.

Life and Critical Illness Cover: The Dual Shield

Many people think of Life Insurance and Critical Illness Cover (CIC) as two separate things, but they are often combined into a single, powerful policy.

-

Life Insurance (Life Protection): This is the most fundamental form of protection. It pays out a tax-free lump sum if you pass away during the policy term. Its purpose is simple: to provide for those you leave behind. This money can be used to:

- Pay off the mortgage, ensuring your family has a secure home.

- Replace your lost income to cover daily living costs.

- Fund future expenses like university fees.

- Cover funeral costs.

-

Critical Illness Cover (CIC): This is protection for you, while you are alive. It pays out a tax-free lump sum if you are diagnosed with one of a list of specific, serious conditions defined in the policy (e.g., heart attack, stroke, most forms of cancer, multiple sclerosis). The genius of CIC is that it addresses the financial consequences of surviving a major illness. This lump sum provides breathing room, allowing you to:

- Clear debts like credit cards or car loans to reduce your monthly outgoings.

- Adapt your home if you have new mobility needs.

- Pay for private treatment or specialist care not available on the NHS.

- Take an extended period off work to recover fully, without financial pressure.

Combining these two gives you a policy that protects your family if the worst happens, and protects your financial stability if you face a life-altering health challenge.

Income Protection: Your Monthly Salary Lifeline

If your life insurance protects your family after you’re gone, Income Protection (IP) protects you and your family while you’re here. It is arguably the most important insurance policy for anyone of working age.

What is it? Income Protection is designed to pay you a regular, tax-free monthly income if you are unable to work due to any illness or injury. It continues to pay out until you can return to work, reach the end of the policy term, retire, or pass away, whichever comes first.

Why is it the bedrock of financial planning? It protects your single greatest asset: your ability to earn an income. Without an income, everything else falls apart.

Key features to understand:

- Benefit Amount: You can typically insure up to 50-70% of your gross monthly income. This is designed to replace the majority of your take-home pay.

- Deferred Period: This is the waiting period from when you stop working to when the policy starts paying out. It can range from 4 weeks to 52 weeks. The longer the deferred period you choose, the lower your premium. You can align this with any sick pay you receive from your employer.

- Definition of Incapacity: The best policies use an 'Own Occupation' definition. This means the policy will pay out if you are unable to do your specific job. Less comprehensive definitions like 'Suited Occupation' or 'Any Occupation' are harder to claim on and should be carefully considered.

Let's compare Income Protection to Statutory Sick Pay (SSP):

| Feature | Income Protection (Example) | Statutory Sick Pay (SSP) |

|---|---|---|

| Benefit Amount | £2,000/month (based on £40k salary) | £116.75/week (approx. £506/month) |

| Payment Duration | Until you return to work or retire | Maximum of 28 weeks |

| Coverage | Any illness or injury preventing work | As per government rules |

| Availability | Must be purchased privately | Available to most employees |

The difference is staggering. SSP is a short-term stopgap; Income Protection is a long-term solution that preserves your financial life.

Family Income Benefit: A Smarter Way to Protect

While a lump-sum life insurance payout is valuable, it can be overwhelming for a grieving family to manage. Family Income Benefit (FIB) offers an elegant alternative or supplement.

Instead of a single large payout on death, FIB provides a series of regular, tax-free monthly or annual payments to your family. These payments continue from the time of the claim until the policy's end date.

Why is it so effective? It directly replaces the deceased's monthly salary, making it far easier for the surviving partner to budget and manage household finances. It feels familiar and manageable.

Example: A 35-year-old couple with two young children takes out a 20-year FIB policy to provide £2,500 a month. If one of them passes away five years into the policy, the plan would pay out £2,500 every month for the remaining 15 years, providing a steady, reliable income stream until the children are likely to be financially independent.

Tailored Protection for Every Walk of Life

A one-size-fits-all approach to protection doesn't work. Your profession, business structure, and life stage dictate your specific vulnerabilities and needs.

For the Self-Employed and Freelancers: The Ultimate Safety Net

If you're self-employed, you are your own financial safety net. There is no employer sick pay, no death-in-service benefit, and no one to fall back on. This makes protection insurance a non-negotiable part of your business plan.

- Income Protection is Essential: This is your sick pay. An 'Own Occupation' IP policy is critical to ensure that if you can't do your specific job (whether you're a writer with RSI or a consultant with burnout), your income is protected.

- Critical Illness Cover is a Business-Saver: A lump sum from a CIC policy can inject vital cash to keep your business afloat, hire temporary help, or simply give you the time to recover without losing everything you've built.

For Tradespeople, Nurses, and Electricians: Personal Sick Pay

For those in physically demanding or higher-risk jobs, a traditional long-term Income Protection policy can sometimes be more expensive. This is where Personal Sick Pay insurance (also known as Accident & Sickness cover) comes in.

These policies are a form of short-term income protection. They typically pay out for a limited period, often 12 or 24 months per claim. While they don't offer the lifelong protection of a full IP policy, they are often more affordable and provide a crucial buffer against the most common scenarios – like an injury or short-term illness that keeps you off the tools for several months.

| Protection Type | Best For | Typical Payout Duration |

|---|---|---|

| Long-Term Income Protection | Office workers, professionals, self-employed seeking comprehensive cover. | Until retirement age. |

| Personal Sick Pay (Short-Term) | Manual workers, tradespeople, those in higher-risk jobs seeking affordable cover. | 1, 2, or 5 years per claim. |

For Company Directors and Business Owners: Protecting More Than Just Yourself

If you run a limited company, you have access to powerful and tax-efficient ways to protect not just yourself, but the business itself.

- Executive Income Protection: This is an Income Protection policy paid for by your company, for your benefit as a director. The premiums are typically considered an allowable business expense, making it highly tax-efficient. The benefit is paid to the company, which then distributes it to you via PAYE.

- Key Person Insurance: Who in your business is indispensable? A star salesperson? The technical genius with all the IP in their head? Key Person Insurance is a life and/or critical illness policy taken out by the business on such an employee. If that person passes away or suffers a serious illness, the policy pays a lump sum to the business. This money can be used to cover lost profits, recruit a replacement, or reassure lenders and investors that the business can survive the loss. It's about ensuring business continuity.

- Relevant Life Cover: This is a tax-efficient death-in-service benefit for directors and employees of small businesses. The company pays the premium, but the payout goes directly to the employee's family, bypassing the business and typically free from Inheritance Tax.

Advanced Strategies for Complete Financial Peace of Mind

Once the core foundations are in place, you can add further layers of protection that cater to specific, modern challenges.

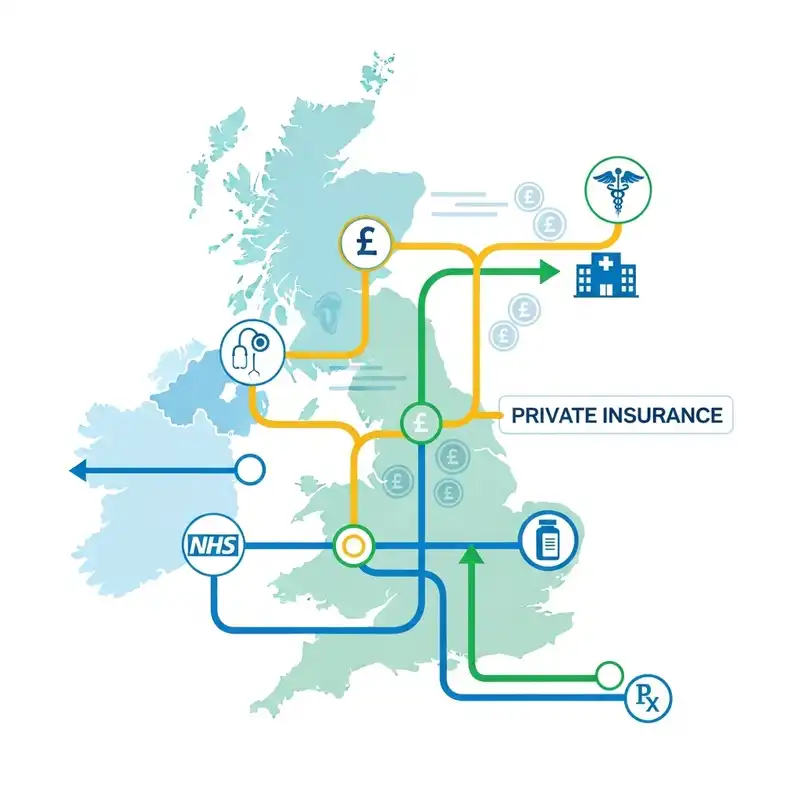

Private Medical Insurance (PMI): Taking Control of Your Health Journey

With NHS waiting lists at record levels, waiting months for a diagnosis, a scan, or surgery can be agonising. Private Medical Insurance (PMI) is your key to bypassing these queues.

The benefits are transformative:

- Speed of Access: Get prompt appointments with specialists and consultants.

- Fast Diagnostics: Quickly get the scans (MRI, CT, PET) you need to understand what's wrong.

- Choice and Comfort: Choose your surgeon, your hospital, and benefit from a private room for your recovery.

- Access to Specialist Treatments: Some policies provide access to new drugs or treatments not yet available on the NHS.

PMI isn't a replacement for the NHS, which remains world-class for emergency care. It's a complementary tool that works alongside it, putting you back in control of your health and recovery timeline. For anyone whose livelihood depends on their physical or mental wellbeing, the ability to get back to work and life faster is invaluable.

Gift Inter Vivos Insurance: Securing Your Legacy

Here’s a scenario many families face: you are in a fortunate position to help your children onto the property ladder by gifting them a substantial deposit. Under UK law, this is a Potentially Exempt Transfer (PET). If you survive for seven years after making the gift, it becomes fully exempt from Inheritance Tax (IHT).

However, if you pass away within those seven years, the gift becomes part of your estate and could be subject to IHT on a sliding scale. This could leave your child with an unexpected and significant tax bill on the gift you so generously gave.

Gift Inter Vivos (GIV) insurance is a special type of life insurance designed to solve this exact problem. It’s a policy that runs for a seven-year term, with a decreasing payout that mirrors the declining IHT liability on the gift. It ensures that if you die within the seven-year window, the insurance payout covers the tax bill, and your gift is received in full by your loved ones, just as you intended. It's the final step in truly securing your legacy.

The WeCovr Approach: Your Partner in Protection and Wellbeing

Navigating this complex landscape can feel daunting. The sheer number of products, providers, and policy details can be overwhelming. This is where seeking expert, independent advice is not just helpful, but essential.

At WeCovr, we see financial protection as an integral part of your overall wellbeing and personal growth strategy. Our philosophy is built on understanding you, your ambitions, and your unique circumstances to build a protection portfolio that truly fits. We partner with you to compare plans from all the UK's major insurers, ensuring you get the right cover at the most competitive price. Our role is to demystify the process, explain the options in plain English, and empower you to make informed decisions.

Furthermore, our commitment to your health extends beyond the point of a claim. We believe proactive health management is a key part of long-term resilience. That's why WeCovr provides our valued clients with complimentary access to our proprietary AI-powered calorie tracking app, CalorieHero. By helping you manage your diet and health, we're investing in your long-term wellbeing, demonstrating that we care about preventing illness just as much as we care about protecting you from its financial impact.

Your Action Plan: 5 Steps to Building Your Financial Foundation

Feeling motivated to act? Here are five practical steps you can take today to start building your financial fortress.

- Conduct a Personal Audit: Sit down and assess your situation honestly. What debts do you have (mortgage, loans)? Who depends on your income? What savings or employer benefits do you currently have?

- Stress-Test Your Finances: Ask the tough questions. What would happen if your income stopped tomorrow? How long could you survive on your savings? Be realistic.

- Prioritise Your Needs: You may not be able to afford every type of cover at once. What is the biggest risk you face? For most people, protecting their income is the number one priority.

- Seek Independent, Expert Advice: This is the single most important step. A specialist protection adviser, like the team at WeCovr, can analyse your needs, explain the nuances of different policies (like the critical 'own occupation' definition for IP), and search the entire market for you. This saves you time, money, and ensures you don't end up with inadequate cover.

- Review and Adapt: Your protection needs are not static. Get in the habit of reviewing your cover every few years, or whenever you have a major life event – getting married, having a child, buying a home, or starting a business.

Conclusion: The Freedom to Grow

We began by talking about the relentless pursuit of our 'best lives'. The irony is that the most powerful catalyst for this pursuit isn't another productivity hack or career goal. It's the quiet confidence that comes from knowing you are protected.

Strategic financial resilience is not about dwelling on the worst-case scenarios. It's about removing them as a source of underlying anxiety. It's about giving yourself and your family the ultimate gift: the freedom to live boldly, to dream big, and to grow without fear.

By building a robust financial foundation with the right mix of life, health, and income protection, you are not just buying an insurance policy. You are investing in peace of mind. You are safeguarding your hard work. You are underwriting your ambitions. You are protecting the future you're working so tirelessly to create. And that is the unspoken, yet most essential, pillar of all personal growth.

Is protection insurance really expensive?

I'm young and healthy. Do I really need cover now?

What's the main difference between Income Protection and Critical Illness Cover?

Can I get insurance if I have a pre-existing medical condition?

What is an "own occupation" definition and why is it important for Income Protection?

Why should I use an insurance broker instead of going to an insurer directly?

Sources

- Office for National Statistics (ONS): Mortality and population data.

- Association of British Insurers (ABI): Life and protection market publications.

- MoneyHelper (MaPS): Consumer guidance on life insurance.

- NHS: Health information and screening guidance.