TL;DR

The statistics are sobering and impossible to ignore. According to projections from Cancer Research UK, a staggering 1 in 2 people in the UK born after 1960 will be diagnosed with some form of cancer during their lifetime. It’s a reality that touches every family, every community, and every individual.

Key takeaways

- Rapid GP & Specialist Access: Many policies offer access to a 24/7 digital GP service, allowing you to get a referral in hours. Once you have that referral, you can typically see a leading specialist of your choice within days. This condenses a process that can take weeks on the NHS into a matter of 72 hours.

- Advanced Diagnostics on Demand: The wait for an MRI or PET-CT scan is a major source of delay and anxiety. With PMI, these scans are often arranged within 48-72 hours at a state-of-the-art private facility, giving your consultant the information they need to make a swift and accurate diagnosis.

- Choice and Comfort: PMI gives you control. You can choose your oncologist or surgeon from a network of leading experts. You can choose the hospital where you receive your treatment, often with the benefit of a private, en-suite room for a more comfortable and dignified experience during a difficult time.

- Access to Cutting-Edge Treatments: This is one of the most powerful benefits of comprehensive cancer cover. You can gain access to the very latest drugs, therapies, and treatments—some of which may not yet be approved by NICE (the National Institute for Health and Care Excellence) for use on the NHS, or are only available through the limited Cancer Drugs Fund.

- Age: Premiums increase as you get older.

Cancer the UK''s Race Against Time

The statistics are sobering and impossible to ignore. According to projections from Cancer Research UK, a staggering 1 in 2 people in the UK born after 1960 will be diagnosed with some form of cancer during their lifetime. It’s a reality that touches every family, every community, and every individual. (illustrative estimate)

When faced with a potential cancer diagnosis, one variable matters more than any other: time. Every day that passes can impact the stage of diagnosis, the range of treatment options available, and ultimately, the prognosis. The race against time begins the moment a worrying symptom appears.

While our National Health Service (NHS) provides exceptional care, it is a system facing unprecedented strain. Waiting lists for specialist appointments, diagnostic tests, and treatment commencement are a well-documented reality. For anyone navigating the fear and uncertainty of a possible cancer diagnosis, these delays can be agonising.

This is where Private Medical Insurance (PMI) emerges not as a luxury, but as a crucial tool for taking control of your health. It offers a parallel pathway to the UK's leading cancer specialists and facilities, dramatically reducing waiting times and unlocking access to treatments that may not be available on the NHS.

This comprehensive guide will explore the landscape of cancer care in the UK, the challenges within the current system, and how a robust private health insurance policy can provide the speed, choice, and advanced care necessary to give you and your loved ones peace of mind and the best possible chance of a full and swift recovery.

The Stark Reality: Cancer in the UK in 2025

Understanding the scale of the challenge is the first step. The "1 in 2" figure is not just a headline; it's a demographic reality driven by people living longer lives, as the risk of most cancers increases with age. As we look at the UK in 2025, the picture is one of increasing pressure and urgency. (illustrative estimate)

Key Statistics Shaping the UK Cancer Landscape:

- Incidence: There are around 393,000 new cancer cases in the UK every year – that's more than 1,000 every single day.

- Prevalence: An estimated 3 million people were living with cancer in the UK at the end of 2020, with projections suggesting this will rise to 4 million by 2030.

- Most Common Cancers: The four most common cancers continue to be breast, prostate, lung, and bowel cancer, accounting for over half (53%) of all new cases in the UK.

- Survival: The good news is that cancer survival has doubled in the last 50 years. Today, half of people diagnosed with cancer in the UK survive their disease for ten years or more. This progress is a testament to research, but early diagnosis is the cornerstone of this success.

This progress, however, is threatened by the single biggest bottleneck in the system: waiting times.

The Critical Impact of Waiting Times

For cancer, time is tissue. Delays in diagnosis can allow a cancer to grow or spread, potentially moving it from an early, more treatable stage to an advanced one.

- One Month Delay: Research published in the British Medical Journal (BMJ) found that even a one-month delay in starting treatment can raise the risk of death by around 10%.

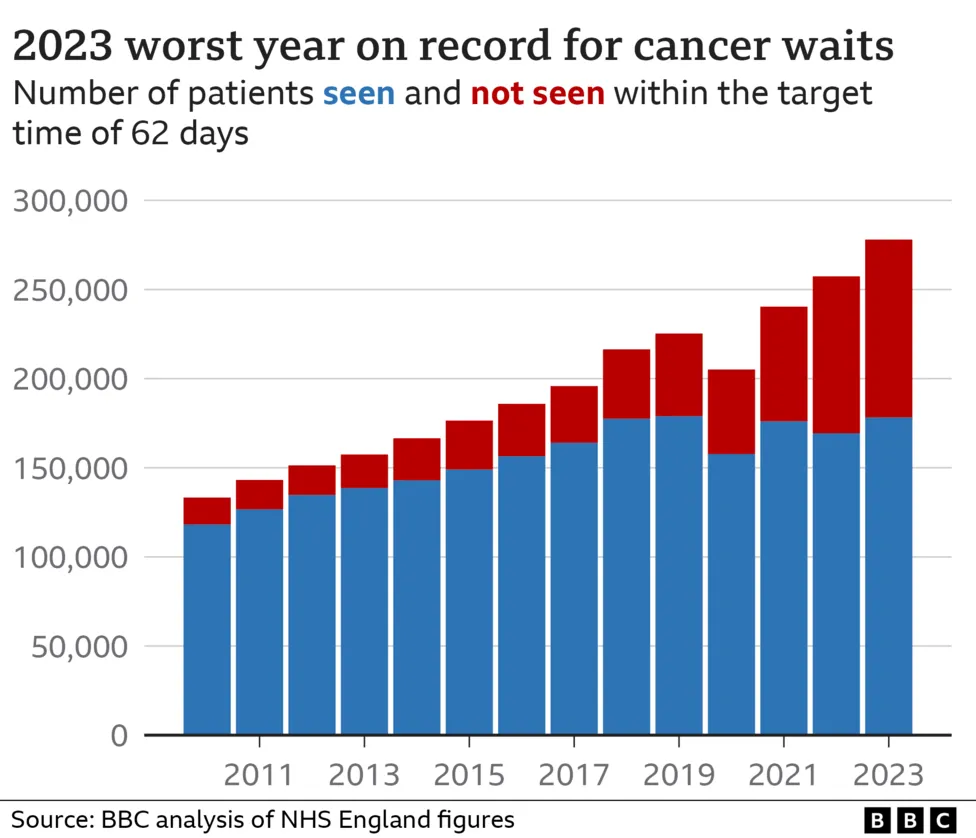

- NHS Performance: Despite the heroic efforts of NHS staff, performance against key cancer waiting time targets has been consistently challenged. As of early 2025, a significant number of patients are waiting longer than the benchmark for diagnosis and treatment.

| NHS Cancer Waiting Time Target (England) | The Target | Recent Performance (Q1 2025 Estimate) |

|---|---|---|

| Urgent Referral (2-Week Wait) | 93% of patients to see a specialist within 2 weeks of GP referral. | Target not met consistently since 2018. |

| Diagnosis (28-Day Faster Diagnosis Standard) | 75% of patients to have cancer ruled out or diagnosed within 28 days. | Consistently below the 75% target. |

| Treatment (62-Day Referral to Treatment) | 85% of patients to start first treatment within 62 days of urgent GP referral. | Significantly below target; a major area of concern. |

Source: Adapted from NHS England data and trend analysis.

These are not just numbers on a spreadsheet. Each percentage point represents thousands of individuals and their families waiting in a state of profound anxiety. This is the gap that Private Medical Insurance is designed to bridge.

The NHS Cancer Pathway: A System Under Strain

The NHS provides a structured and defined pathway for cancer care, which, when it works to its targets, is world-class. It's important to understand this process to see where delays can occur and how PMI offers an alternative route.

The Standard NHS Journey:

- GP Visit: You notice a symptom and visit your GP. They assess you and, if they suspect cancer, make an 'urgent referral' to a specialist. The target is for this appointment to happen within two weeks.

- Specialist Consultation: You meet with a consultant (e.g., an oncologist, a gastroenterologist) at an NHS hospital.

- Diagnostic Tests: The specialist will order necessary tests to investigate. This could include blood tests, X-rays, and more advanced imaging like MRI, CT, or PET scans. There can be significant waits for these scan appointments.

- Diagnosis & Staging: Following the tests, a multidisciplinary team (MDT) reviews your case to confirm a diagnosis and determine the cancer's stage and characteristics.

- Treatment Plan: The MDT recommends a treatment plan, which is discussed with you. This could involve surgery, chemotherapy, radiotherapy, or other therapies.

- Treatment Commencement: You begin your first definitive treatment. The target from the initial urgent referral to this point is 62 days.

The NHS itself is the first to acknowledge the immense pressure it is under. A combination of factors, including funding constraints, persistent staffing shortages, an ageing infrastructure, and the long-tail effects of the COVID-19 pandemic on backlogs, all contribute to the system operating well beyond its ideal capacity.

This is the context in which thousands of Britons are now considering private healthcare—not to replace the NHS, but to gain rapid access when it matters most.

Private Medical Insurance: Your Fast-Track to World-Class Cancer Care

Private Medical Insurance (PMI) is a policy you pay for that covers the cost of private medical treatment for acute conditions. It works alongside the NHS, giving you a choice in how, where, and when you are treated.

For cancer, its primary benefit is speed. A PMI policy allows you to bypass NHS waiting lists at every single stage of the cancer pathway.

A Critical Clarification: Pre-Existing and Chronic Conditions

Before we delve into the benefits, it is absolutely essential to understand a fundamental rule of UK private medical insurance.

Standard PMI policies are designed to cover acute conditions that arise after your policy begins.

- An acute condition is a disease, illness, or injury that is likely to respond quickly to treatment and lead to a full recovery (e.g., joint replacements, hernias, and, crucially, new cancer diagnoses).

- A chronic condition is an illness that cannot be cured but can be managed through medication and therapy (e.g., diabetes, asthma, high blood pressure). These are not covered by PMI and remain under the care of the NHS.

- A pre-existing condition is any illness or symptom you had before you took out the policy. Standard PMI policies will not cover you for these conditions, typically for a set period (e.g., two years) or indefinitely, depending on the type of underwriting you choose.

Therefore, you cannot buy a PMI policy to cover a cancer you have already been diagnosed with. The value of PMI lies in having it in place before you need it, as a safety net for future, unforeseen diagnoses.

The Core Benefits of PMI for Cancer Care

With that crucial point understood, let's explore how PMI transforms the cancer journey for policyholders.

- Rapid GP & Specialist Access: Many policies offer access to a 24/7 digital GP service, allowing you to get a referral in hours. Once you have that referral, you can typically see a leading specialist of your choice within days. This condenses a process that can take weeks on the NHS into a matter of 72 hours.

- Advanced Diagnostics on Demand: The wait for an MRI or PET-CT scan is a major source of delay and anxiety. With PMI, these scans are often arranged within 48-72 hours at a state-of-the-art private facility, giving your consultant the information they need to make a swift and accurate diagnosis.

- Choice and Comfort: PMI gives you control. You can choose your oncologist or surgeon from a network of leading experts. You can choose the hospital where you receive your treatment, often with the benefit of a private, en-suite room for a more comfortable and dignified experience during a difficult time.

- Access to Cutting-Edge Treatments: This is one of the most powerful benefits of comprehensive cancer cover. You can gain access to the very latest drugs, therapies, and treatments—some of which may not yet be approved by NICE (the National Institute for Health and Care Excellence) for use on the NHS, or are only available through the limited Cancer Drugs Fund.

Unpacking Cancer Cover: What Do PMI Policies Actually Include?

Not all PMI policies are created equal, and the level of cancer cover is one of the most significant differentiators. When you buy a policy, cancer cover is often structured in tiers.

Basic Cover: Some entry-level policies may have limits on cancer care. They might cover the initial diagnosis and surgery but could have financial or time limits on treatments like chemotherapy and radiotherapy. These are less common but it's vital to check.

Comprehensive Cancer Cover (The Gold Standard): This is the option most people seek and is included as standard in most mid-to-high-tier policies. It is designed to cover your cancer journey from diagnosis to treatment and aftercare, without placing financial or time limits on your care, as long as you keep your policy active.

Here’s what you can typically expect from a comprehensive cancer plan:

| Feature | Description | Why It Matters |

|---|---|---|

| Initial Diagnostics | Covers consultations and tests to diagnose cancer. | Bypasses NHS waits for scans, leading to faster diagnosis. |

| Surgery | Includes tumour removal and reconstructive surgery (e.g., post-mastectomy). | Access to leading surgeons and choice of hospital. |

| Chemotherapy | Covers the cost of chemotherapy drugs and their administration. | Can be administered at home for comfort or in a private hospital. |

| Radiotherapy | Covers standard and advanced radiotherapy, like IMRT. | Access to the latest technology to target tumours precisely. |

| Advanced Therapies | Includes targeted therapies, immunotherapy, and biological therapies. | Access to cutting-edge treatments not always on the NHS. |

| Proton Beam Therapy | A highly targeted radiotherapy, often included for specific clinical needs. | Reduces damage to surrounding tissue; a vital option for certain tumours. |

| Ongoing Monitoring | Covers check-ups and scans after your initial treatment is complete. | Ensures any recurrence is caught early. |

| Palliative Care | Covers care focused on symptom control and quality of life if cancer is incurable. | Provides dignity and comfort, often including hospice care or at-home nursing. |

| Support Services | Includes dedicated nurse support lines, mental health counselling, and wig provision. | Holistic support for the emotional and physical toll of cancer. |

The Power of Experimental and Unlicensed Drugs

One of the most compelling reasons to opt for comprehensive cancer cover is the potential to access drugs that are yet to receive NICE approval. The UK's drug approval process is rigorous and can be slow. A new, promising cancer drug might be licensed for use in Europe or the US but still be months or even years away from routine NHS availability.

Many top-tier PMI policies will cover a drug provided it is licensed by the relevant authorities, even if it's not yet NICE-approved. For some patients, this can open the door to a life-extending or life-saving treatment that would otherwise be out of reach.

The Journey with PMI: A Tale of Two Timelines

To illustrate the profound difference PMI can make, let’s consider a hypothetical but realistic scenario of two 50-year-old men, David and Mark, who both discover a worrying lump.

David's Journey (Relying solely on the NHS)

- Week 1: David sees his GP. The GP is concerned and makes an urgent two-week wait referral.

- Week 3: David sees a specialist at his local NHS hospital. The specialist recommends a biopsy and a CT scan to investigate.

- Week 6: David has his CT scan. The waiting list was four weeks, but he got a cancellation.

- Week 7: He has his biopsy.

- Week 8: A multidisciplinary team reviews the results. David gets a call to come in.

- Week 9: David is diagnosed with stage 2 bowel cancer. His team recommends surgery.

- Week 12: David has his surgery. The total time from GP visit to treatment is around 84 days, exceeding the 62-day target. He is grateful for the excellent care but found the 12-week wait incredibly stressful.

Mark's Journey (With a Comprehensive PMI Policy)

- Day 1: Mark sees a private GP via his insurer's app. The GP gives him an open referral to a gastroenterologist.

- Day 3: Mark sees a leading consultant of his choice at a private hospital. The consultant arranges an urgent CT scan and colonoscopy with biopsy.

- Day 5: Mark has his CT scan and colonoscopy.

- Day 8: The consultant calls Mark with the results. It's stage 1 bowel cancer, caught very early.

- Day 14: Mark has keyhole surgery with a top surgeon. The total time from symptom to treatment is two weeks. He is back at his desk, recovering, before David has even had his first scan.

This is a simplified example, but it powerfully illustrates the core value proposition of PMI: it buys you time. In Mark's case, this not only reduced anxiety but led to the cancer being caught at an earlier stage, improving his long-term prognosis.

Demystifying the Costs: Is Private Cancer Care Affordable?

The cost of a PMI policy is a primary consideration for most people. Premiums are highly individual and depend on several factors:

- Age: Premiums increase as you get older.

- Location: Costs can be higher in central London and other major cities due to higher hospital charges.

- Level of Cover: A comprehensive plan with full cancer cover will cost more than a basic one.

- Excess (illustrative): This is the amount you agree to pay towards a claim. A higher excess (£500 or £1,000) will significantly lower your monthly premium.

- Hospital List: Choosing a policy with a more restricted list of hospitals (e.g., excluding the most expensive central London facilities) can also reduce costs.

To provide a sense of the potential costs, here are some illustrative examples for a comprehensive policy with full cancer cover and a £250 excess.

| Profile | Estimated Monthly Premium |

|---|---|

| 30-year-old non-smoker | £45 - £65 |

| 45-year-old non-smoker | £70 - £95 |

| 60-year-old non-smoker | £120 - £180 |

Disclaimer: These are illustrative estimates only. Your actual premium will depend on your specific circumstances and the insurer you choose.

While these costs are not insignificant, many people view them as a worthwhile investment in their health and peace of mind, often comparing the monthly cost to a gym membership or mobile phone contract.

Navigating the dozens of policies and providers can be overwhelming. This is where an expert broker becomes invaluable. At WeCovr, we specialise in helping individuals and families compare plans from every major UK insurer, including Aviva, Bupa, AXA Health, and Vitality. We take the time to understand your specific needs and budget to find the policy that offers the right protection at the right price.

Furthermore, we believe in proactive health. That’s why all WeCovr customers gain complimentary access to CalorieHero, our exclusive AI-powered nutrition and calorie tracking app. It’s our way of going above and beyond the policy, helping you manage your health day-to-day.

Choosing the Right Policy: Key Questions to Ask

When you are ready to explore your options, it's crucial to ask the right questions to ensure the policy you choose provides the robust cancer protection you expect.

Here is a checklist to guide your conversation with an adviser:

- What is the overall philosophy on cancer care? Ask for the "full cancer cover" or "comprehensive cancer care" option.

- Are there any limits? Check if there are any financial caps (£) or time limits on any part of the cancer treatment. The best policies have no limits.

- How are advanced treatments handled? Specifically ask about drugs that are not yet NICE-approved, as well as targeted therapies and immunotherapies.

- Is palliative care included? Understand what cover is provided for end-of-life care if the cancer becomes terminal.

- What support services are built-in? Look for features like a dedicated cancer nurse helpline, mental health support, and other practical benefits like wig provision or home nursing.

- Does the cover continue if my cancer becomes chronic? This is a key question. You want a policy that promises to continue covering your cancer care, even if it is no longer deemed 'curable' but requires ongoing management.

- What are the outpatient limits? Ensure your pre-diagnostic consultations and tests are fully covered to avoid unexpected shortfalls.

Navigating the Market with an Expert Broker

You can buy PMI direct from an insurer, but you will only be told about their own products. An independent health insurance broker works for you, not the insurance company.

The benefits of using a broker like WeCovr are clear:

- Whole-of-Market View: We compare policies and prices from across the entire market, ensuring you see all the best options.

- Expert, Unbiased Advice: We demystify the jargon and explain the subtle but crucial differences between policies, helping you understand exactly what you are buying.

- Tailored Recommendations: We don't do "one-size-fits-all." We provide a recommendation based on your unique health needs, family situation, and budget.

- Support for Life: Our service doesn't stop once you've bought the policy. We are here to help you at renewal and, most importantly, provide guidance if you ever need to make a claim.

Frequently Asked Questions (FAQ)

1. I've already had cancer. Can I get PMI to cover it? No. Cancer would be considered a pre-existing condition and will be excluded from a new policy. The time to get health insurance is when you are healthy.

2. Will my premium go up if I claim for cancer treatment? Yes, it is very likely your premium will increase at your next renewal following a significant claim for cancer. A broker can help you review options at renewal if the increase is too high.

3. Can I mix and match PMI and the NHS? Absolutely. This is very common. For example, you might use your PMI for a rapid diagnosis and surgery, then opt to have your chemotherapy on the NHS closer to home. The choice is yours.

4. What happens if my cancer is diagnosed as terminal? Does the cover stop? No. Most comprehensive policies include palliative care. This means the insurer will continue to fund treatment focused on managing symptoms and improving your quality of life, which can include hospice care or specialist nurses at home.

5. Does PMI cover routine cancer screening like mammograms or smear tests? Generally, no. PMI is for investigating symptoms. Routine, asymptomatic screening is typically done via the NHS national screening programmes. However, if a screening test reveals an issue, PMI would then kick in for the subsequent diagnostic tests and treatment.

6. Are all types of cancer covered? Yes, provided the cancer is an acute condition that first occurs after you have taken out your policy, it will be covered. This includes rare cancers as well as the more common types.

Conclusion: Take Control of Your Health Future

The prospect of a 1 in 2 lifetime risk of cancer is daunting. But in the face of this challenge, knowledge and preparation are your greatest allies. While we are fortunate to have the NHS, its structural pressures mean that waiting for care is an undeniable part of the patient experience for many.

Private Medical Insurance offers a powerful and proven solution. It is a strategic investment in speed, choice, and access to the very best that modern medicine can offer. It's about removing the agonising uncertainty of a waiting list and replacing it with the reassurance of a clear, swift plan of action.

By understanding your options, asking the right questions, and seeking expert advice, you can put a plan in place that gives you and your family the ultimate peace of mind—the knowledge that if the worst should happen, you have a fast track to the care you need, when you need it most. Don't wait. The race against time is one you can prepare for today.

Sources

- NHS England: Waiting times and referral-to-treatment statistics.

- Office for National Statistics (ONS): Health, mortality, and workforce data.

- NICE: Clinical guidance and technology appraisals.

- Care Quality Commission (CQC): Provider quality and inspection reports.

- UK Health Security Agency (UKHSA): Public health surveillance reports.

- Association of British Insurers (ABI): Health and protection market publications.