Beyond the Brochure Your Step-by-Step Guide to Comparing UK Private Health Insurance Policies Effectively

Beyond the Brochure: Your Step-by-Step Guide to Comparing UK Private Health Insurance Policies Effectively

In the ever-evolving landscape of UK healthcare, navigating the options available for private medical treatment can feel like deciphering a complex foreign language. Brochures promise peace of mind, faster access, and choice, but the reality of comparing private health insurance policies goes far "beyond the brochure". It demands a meticulous eye, an understanding of often-confusing terminology, and a clear vision of your personal needs.

For many, the National Health Service (NHS) remains the cornerstone of healthcare in the UK, providing excellent care in emergencies and for critical conditions. However, increasing pressures on the NHS often mean longer waiting lists for elective procedures, limited choice of consultant, and less flexibility in appointment scheduling. This is where Private Medical Insurance (PMI) steps in, offering a supplementary layer of care designed to provide speed, comfort, and control over your medical journey.

But with numerous providers, countless policy variations, and a myriad of optional extras, how do you genuinely compare policies to ensure you're getting the best value and, more importantly, the most suitable cover for your unique circumstances? This comprehensive guide is designed to empower you, providing a step-by-step roadmap to effectively compare UK private health insurance policies, avoiding common pitfalls, and making an informed decision that safeguards your health and your finances.

We'll peel back the layers of marketing jargon, demystify complex terms, and equip you with the knowledge to look past the headline price. By the end of this guide, you’ll be an informed consumer, ready to make choices that truly serve your healthcare needs.

Understanding the UK Private Health Insurance Landscape

Before diving into the nitty-gritty of comparison, it's essential to grasp what Private Medical Insurance (PMI) is and how it fits into the broader UK healthcare system.

What is Private Medical Insurance (PMI)?

Private Medical Insurance, often simply referred to as health insurance, is an insurance policy that covers the costs of private healthcare for acute conditions. An "acute condition" is a disease, illness or injury that is likely to respond quickly to treatment, or that is short-term in nature. It's designed to give you access to private hospitals, consultants, and treatments, offering an alternative to, or speeding up access beyond, what might be available on the NHS.

PMI typically covers the costs of diagnosis (such as MRI scans, CT scans, blood tests), consultation fees (with specialists), and treatment (including surgery, rehabilitation, and sometimes certain drugs) for eligible conditions.

Why Consider PMI in the UK?

While the NHS provides universal healthcare, many individuals and families opt for PMI due to several compelling benefits:

- Faster Access to Diagnosis and Treatment: One of the primary drivers for purchasing PMI is the ability to bypass NHS waiting lists. For elective procedures or non-urgent consultations, PMI can significantly reduce the time from symptom to diagnosis and treatment. This can be crucial for peace of mind and faster recovery.

- Choice of Consultant and Hospital: With PMI, you often have the freedom to choose your consultant and the hospital where you receive treatment. This allows you to select specialists based on reputation, experience, or personal recommendation, and to pick a hospital location that is convenient for you.

- Comfort and Privacy: Private hospitals typically offer a higher level of comfort and privacy. This often includes private en-suite rooms, more flexible visiting hours, and better catering options, contributing to a more comfortable recovery experience.

- Access to Specific Drugs and Treatments: Some policies may provide access to certain drugs or treatments that are not yet widely available on the NHS, or for which there are specific NHS eligibility criteria. This is not always the case and depends heavily on the policy and the insurer's approved list, but it can be a significant benefit for certain conditions.

- Defined Appointment Times: Private appointments are usually scheduled at a specific time, reducing the need for long waits in clinics, common in NHS settings.

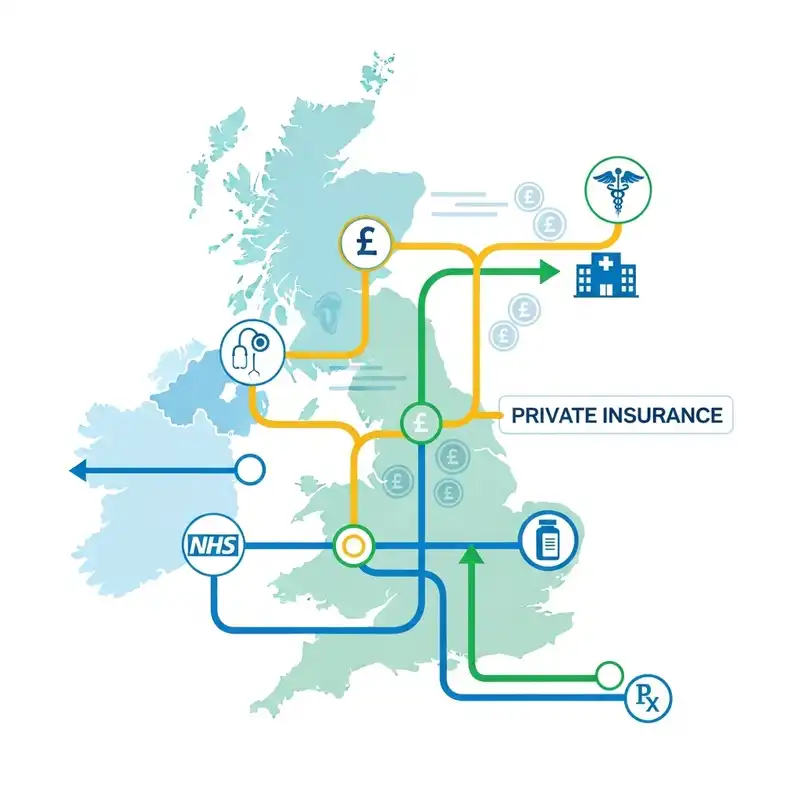

Key Players in the UK Market

The UK private health insurance market is served by a number of reputable insurers, each offering a range of policies. While we won't list them all, major providers include household names. Each insurer has its own strengths, specialist areas, and policy nuances, which underscores the importance of a thorough comparison.

The Relationship Between PMI and the NHS

It is crucial to understand that PMI is supplementary to the NHS, not a replacement. For any life-threatening emergency, serious accident, or immediate acute care, the NHS is always the first port of call. Your private health insurance policy will not cover emergency services such like A&E visits or immediate ambulance transportation. PMI is designed for planned treatments and elective procedures, or for conditions that, while needing care, are not immediate emergencies.

Furthermore, even with PMI, certain aspects of your care might still involve the NHS. For example, your GP (who is part of the NHS) will usually be your first point of contact for any health concern. They will then refer you to a private consultant if you wish to use your insurance.

Dispelling Common Myths and Misconceptions

Before we delve deeper, let's tackle some pervasive myths that can often mislead individuals when considering private health insurance.

Myth 1: Private Medical Insurance Covers Everything

Reality: This is perhaps the biggest and most critical misconception. Private Medical Insurance policies in the UK are designed to cover acute conditions, not chronic or pre-existing conditions. We will delve into this in much greater detail, but it's vital to understand from the outset. If you have a long-term condition that requires ongoing management, or if you've had symptoms or treatment for a condition before taking out the policy, it is highly unlikely to be covered. Policies also have standard exclusions for things like normal pregnancy, fertility treatment, cosmetic surgery (unless medically necessary due to injury/illness), and substance abuse.

Myth 2: It's Only for the Wealthy

Reality: While private health insurance can be a significant investment, there are policies available to suit a wide range of budgets. Options such as higher excesses, restricted hospital lists, or "basic" core cover (e.g., in-patient only) can significantly reduce premiums, making PMI more accessible than many assume. The key is to find a policy that balances affordability with the level of cover you genuinely need.

Myth 3: Once I Have It, I'm Set for Life

Reality: Your healthcare needs, the market, and policy terms can change over time. It's crucial to review your policy annually to ensure it still meets your needs and offers competitive value. What was suitable five years ago might not be today. Furthermore, insurers can adjust premiums and terms at renewal.

Myth 4: The NHS is Always Slower

Reality: While PMI generally offers faster access to elective diagnosis and treatment, the NHS remains exceptionally efficient and responsive for emergencies, life-threatening conditions, and acute critical care. For a heart attack or a serious accident, the NHS will always be faster and more appropriate. PMI's advantage lies in planned procedures and consultations where waiting lists might be a factor on the NHS.

Myth 5: It's Too Complicated to Understand

Reality: The world of health insurance does have its complexities, from underwriting methods to various levels of cover and exclusions. However, with the right guidance and a methodical approach, it's entirely possible to understand the core principles and make an informed choice. This guide is designed to simplify that process for you.

Step 1: Define Your Needs and Budget – The Foundation of Your Search

Before you even start looking at policies, the most crucial first step is to sit down and clearly define what you want and what you can realistically afford. This will prevent you from being overwhelmed by options and help you filter out unsuitable policies from the start.

What Are Your Non-Negotiables?

Consider what aspects of private healthcare are most important to you.

- In-patient vs. Out-patient Cover: Do you only want cover for overnight hospital stays and major treatment (in-patient), or do you also want cover for consultations, diagnostic tests (e.g., MRI, CT scans), and minor procedures that don't require an overnight stay (out-patient)? Out-patient cover is often an add-on and significantly increases the premium.

- Mental Health Cover: Is access to private mental health services important to you? Many policies offer optional mental health modules, covering psychotherapy, counselling, or inpatient psychiatric care.

- Therapies and Rehabilitation: Would you want cover for physiotherapy, osteopathy, chiropractic treatment, or other complementary therapies post-treatment? These are often optional extras with limits.

- Choice of Hospital: Do you have a specific private hospital or group of hospitals in mind? Some policies offer restricted hospital lists, which are cheaper but limit your choice.

- Dental and Optical Cover: While typically not part of core PMI, some insurers offer these as separate add-ons for routine check-ups and treatments.

- Cancer Cover: While often included in core policies, the level and scope of cancer cover can vary. Some policies offer access to a broader range of drugs or treatments than others, or include cover for reconstructive surgery.

Who Needs Cover?

Your choice of policy will also depend on who you're insuring:

- Individual Policy: For just yourself.

- Couple Policy: For you and your partner.

- Family Policy: For you, your partner, and your children. Some insurers offer discounts for families, or free cover for younger children.

- Age of Applicants: Premiums generally increase with age, so factor this into your long-term budgeting.

Budgeting Realistically

Honesty about your financial limits is paramount.

- How Much Can You Afford? Determine a realistic monthly or annual amount you are comfortable spending on health insurance. Remember, this is an ongoing cost.

- Understanding Excesses: An excess is the amount you pay towards a claim before the insurer pays out. Choosing a higher excess (e.g., £500 or £1,000 instead of £100) can significantly reduce your annual premium. However, be prepared to pay that amount if you make a claim.

- No Claims Discount (NCD): Similar to car insurance, many health insurance policies offer a No Claims Discount. Each year you don't claim, your NCD increases, leading to a reduction in your premium. Be aware that making a claim will reduce your NCD.

Future Considerations

While no one can predict the future, consider any known potential changes:

- Are you planning to start a family? Pregnancy and childbirth are typically excluded, but complications might be covered.

- Are there any known family health conditions that might emerge later in life? (Remember the strict rules on pre-existing conditions).

By taking the time to define these points, you create a robust framework for your search, ensuring you only consider policies that align with your fundamental requirements and budget.

Step 2: Deciphering Policy Types and Core Cover Options

Once you have a clear idea of your needs, the next step is to understand the fundamental building blocks of a private health insurance policy. This is where terms like "in-patient," "out-patient," and "underwriting" become critical.

In-patient vs. Out-patient Cover

These are the two main categories of medical treatment that health insurance policies differentiate between:

-

In-patient Treatment: This refers to treatment that requires you to be admitted to a hospital bed for at least one night. It also includes "day-patient" treatment, where you're admitted and occupy a bed for treatment but don't stay overnight. Core policies almost always cover in-patient and day-patient treatment for eligible acute conditions. This typically includes:

- Hospital accommodation costs

- Consultant fees for in-patient procedures

- Operating theatre charges

- Drugs and dressings

- Nursing care

- Intensive care

-

Out-patient Treatment: This covers medical treatment, consultations, and diagnostic tests (e.g., MRI, CT scans, X-rays, blood tests) that do not require you to be admitted to a hospital bed. This is usually an optional add-on to a core policy and can significantly increase the premium. Policies may offer:

- Full Out-patient Cover: No monetary limit on eligible out-patient consultations and tests.

- Limited Out-patient Cover: A fixed monetary limit per policy year (e.g., £1,000, £1,500, or £2,000) for out-patient consultations and diagnostic tests. Once this limit is reached, you pay for further out-patient services yourself until the next policy year. This is a common way to reduce premiums.

Many people underestimate the cost of out-patient diagnostic tests and consultations. An MRI scan can easily cost £500-£1,000, and a consultant's follow-up appointment could be £200-£300. Without sufficient out-patient cover, you could quickly deplete a limited allowance or face significant bills.

Hospital Lists/Networks

Insurers work with networks of private hospitals. The "hospital list" your policy uses will dictate which private hospitals you can be treated in:

- Comprehensive/Full Hospital List: This offers access to a wide range of private hospitals across the UK, including those in central London. This provides the most choice but comes at a higher premium.

- Restricted/Limited Hospital List: This excludes certain high-cost hospitals, typically those in central London or very exclusive facilities. Choosing a restricted list can significantly reduce your premium, but you must ensure it includes hospitals convenient for you. If you live outside a major city, a restricted list might still offer plenty of suitable local options.

Underwriting Methods – Crucial to Understand

This is one of the most critical aspects of comparing health insurance policies, as it dictates how your pre-existing conditions are handled. Understanding the underwriting method will prevent nasty surprises when you try to make a claim.

1. Full Medical Underwriting (FMU)

- How it works: When you apply for a policy, you will complete a detailed health questionnaire about your medical history. This will include questions about any past or present conditions, symptoms, treatments, and medication.

- The Outcome: The insurer reviews this information before offering you cover. They will then explicitly tell you what conditions, if any, are permanently excluded from your policy. You will receive a clear list of these "specific exclusions."

- Pros: Provides certainty from day one. You know exactly what is and isn't covered.

- Cons: Can be more time-consuming upfront due to the detailed questionnaire.

2. Moratorium Underwriting

- How it works: When you apply, you generally don't fill out a detailed health questionnaire. Instead, the insurer applies a "moratorium" period (typically 2 years) from the policy start date. Any medical condition you have had symptoms of, or received treatment or advice for, during a set period before the policy start date (usually the last 5 years) will be excluded for the first 2 years of your policy.

- The Outcome: If you go for 2 continuous years after your policy starts without any symptoms, treatment, medication, or advice for that pre-existing condition, it may then become covered. However, if you experience symptoms or need treatment for that pre-existing condition within the 2-year moratorium period, it will remain excluded.

- Pros: Quick and easy to set up, less upfront paperwork.

- Cons: Less certainty upfront. You might not know if a condition is covered until you try to make a claim. This can lead to unexpected denials if you haven't fully understood how moratoriums work.

Example Scenario (Moratorium): You had physiotherapy for a bad back 3 years ago but have been fine since. With a Moratorium policy, your back pain would be a pre-existing condition. If your back pain flared up in the first 2 years of your policy, it would be excluded. If you went 2 full years without any back pain, and then it flared up in year 3, it would likely be covered.

Crucial Note on Pre-existing and Chronic Conditions: Regardless of the underwriting method, individual private health insurance policies will NOT cover pre-existing conditions that have not met the moratorium criteria, nor will they cover chronic conditions. A chronic condition is a disease, illness or injury that has one or more of the following characteristics: it needs long-term management; it has no known cure; it comes back or is likely to come back; it is permanent; or it needs rehabilitation or special training. Examples include diabetes, asthma, hypertension, epilepsy, and most mental health conditions requiring ongoing management. If you have any of these, you will need to continue relying on the NHS for their management. PMI is for new, acute conditions.

3. Continued Personal Medical Exclusions (CPME)

- How it works: This method is specifically for people switching from one private health insurance provider to another. If you've previously had a policy with FMU or completed a moratorium with your old insurer, CPME allows your new insurer to carry over the same exclusions (or conditions that are now covered) from your previous policy.

- Pros: Ensures continuity of cover and prevents conditions that became covered under your previous policy from being re-evaluated as "pre-existing" by the new insurer.

- Cons: Only applies if you're switching and have an existing policy history that can be transferred.

4. Medical History Disregarded (MHD)

- How it works: This is the "gold standard" of underwriting, where all pre-existing conditions are covered from day one.

- Crucial Note: Medical History Disregarded (MHD) is extremely rare for individual policies and is almost exclusively offered on large corporate schemes. Do not expect to find an individual policy that covers your pre-existing conditions, as this is simply not how the UK individual health insurance market operates.

Excess Options

As discussed earlier, the excess is the amount you pay towards your treatment cost for an eligible claim. You usually choose an excess when you take out the policy.

- Per Claim Excess: You pay the excess each time you make a new claim.

- Per Policy Year Excess: You pay the excess only once per policy year, regardless of how many claims you make in that year. This is generally more favourable for policyholders.

Choosing a higher excess will lower your premium, but you must be prepared to pay that amount if you need to use your policy.

No Claims Discount (NCD)

Similar to car insurance, most health insurance policies offer an NCD.

- How it works: For every year you don't make a claim, your NCD level increases, leading to a larger discount on your premium the following year.

- Impact of Claims: If you make a claim, your NCD level will typically drop by a certain number of levels, increasing your premium at renewal. Some insurers offer "NCD protection" as an optional extra, which allows you to make a certain number of claims without impacting your NCD.

Understanding these core elements is fundamental to being able to effectively compare policies. They are the scaffolding upon which the rest of the policy is built.

Step 3: Exploring Important Add-ons and Optional Extras

Beyond the core in-patient and limited out-patient cover, most insurers offer a range of optional extras that can be bolted onto your policy to provide more comprehensive protection. While these add to the premium, they can significantly enhance the value and suitability of your policy.

Mental Health Cover

In recent years, the awareness and importance of mental health support have grown significantly. Many policies now offer mental health modules as an add-on.

- Scope of Cover: This can vary widely. Some offer limited access to out-patient counselling or psychotherapy sessions, while more comprehensive options might cover in-patient psychiatric treatment, day-patient programmes, and a broader range of therapeutic interventions.

- Limits: Be aware of annual limits on the number of sessions or the total monetary value for mental health treatments.

- Exclusions: It's important to note that chronic mental health conditions (e.g., long-term depression, schizophrenia, bipolar disorder) are generally excluded, as are conditions present before you took out the policy (pre-existing). The cover is typically for acute, treatable mental health conditions that arise after your policy starts.

Physiotherapy and Complementary Therapies

For conditions requiring rehabilitation or non-surgical intervention, these add-ons can be invaluable.

- Physiotherapy: Cover for sessions with a private physiotherapist following an injury or treatment. Often comes with a limit on the number of sessions or an annual monetary limit.

- Complementary Therapies: This can include osteopathy, chiropractic treatment, acupuncture, and podiatry. Again, there are usually limits on the number of sessions or a total annual allowance.

- Referral: Often, a GP or specialist referral is required to access these therapies under your policy.

Dental and Optical Cover

While not part of core PMI, some insurers offer these as separate, often small-value, add-ons.

- Dental Cover: Usually covers routine check-ups, hygienist appointments, and minor restorative work (e.g., fillings). Major dental work (e.g., crowns, bridges, orthodontics) is typically excluded or has very high excess/limits.

- Optical Cover: Often covers eye tests and contributes a small amount towards the cost of glasses or contact lenses.

- Reimbursement Basis: These types of add-ons usually work on a reimbursement basis, meaning you pay for the service upfront and then claim back a percentage or a set amount from the insurer.

Cancer Cover Enhancements

While core policies usually include cancer treatment, some insurers offer enhanced cancer cover:

- Advanced Drugs and Therapies: Access to newer, often more expensive drugs or innovative therapies that might not yet be widely available on the NHS.

- Genetic Testing: Cover for genetic tests to determine the most effective treatment pathways.

- Reconstructive Surgery: Cover for reconstructive surgery following cancer treatment.

- Palliative Care: Support for end-of-life care in a private setting.

It's crucial to compare the depth of cancer cover offered by different insurers, as this can be a major differentiator.

Travel Insurance Integration

Some policies may offer limited travel insurance benefits, such as emergency medical expenses cover while abroad. However, this is usually basic and not a substitute for comprehensive travel insurance, especially if you have pre-existing conditions (which would need to be declared specifically for travel insurance). Always check the small print and consider dedicated travel insurance if you travel frequently.

Other Potential Add-ons

- Home Nursing: Cover for a qualified nurse to provide care in your home after a hospital stay.

- Care Pathways/Rehabilitation: Extensive cover for post-operative rehabilitation, including access to specialist facilities.

- Health and Wellbeing Services: Many insurers now offer digital GP services, health helplines, online health assessments, and discounts on gym memberships or health products. These are typically value-added benefits rather than direct medical cover.

When considering add-ons, always weigh their potential benefit against the additional cost. Don't pay for features you are unlikely to use.

Step 4: Understanding Exclusions – What Won't Be Covered?

Understanding what isn't covered is just as important, if not more so, than knowing what is. Exclusions are a fundamental part of any insurance policy, and a thorough grasp of them will prevent disappointment and unexpected bills down the line.

The Golden Rule: Pre-existing and Chronic Conditions

This bears repeating, as it is the most common reason for claims being denied in UK private health insurance.

- Pre-existing Condition: Any disease, illness, or injury for which you have had symptoms, sought advice, or received treatment or medication before the start date of your policy (typically within the last 5 years). These are generally excluded, unless they become covered under a moratorium policy after the specified continuous symptom-free period.

- Chronic Condition: A condition that is permanent, needs long-term management, has no known cure, or is likely to come back. Examples include asthma, diabetes, high blood pressure, epilepsy, most auto-immune diseases, and long-term mental health conditions. Chronic conditions are systematically excluded by individual private health insurance policies. The NHS remains responsible for the ongoing management of chronic conditions. If you develop a chronic condition while insured, your policy will cover the acute phase of diagnosis and initial treatment, but not its ongoing management.

Real-life Example: If you are diagnosed with Type 2 Diabetes after your policy starts, the diagnosis and initial stabilisation treatment might be covered. However, the ongoing management of your diabetes (medication, regular check-ups, monitoring of blood sugar levels, or treatment for complications arising from your diabetes) would not be covered. You would revert to the NHS for this long-term care.

Standard Exclusions (Across Most Policies)

While specific exclusions can vary between insurers, many common exclusions apply across the board:

- Emergency Services: A&E visits, ambulance services, emergency operations. You must use the NHS for these.

- Normal Pregnancy and Childbirth: Policies generally exclude routine maternity care. However, complications arising from pregnancy (e.g., ectopic pregnancy, pre-eclampsia) might be covered, depending on the policy wording. Fertility treatment is also typically excluded.

- Cosmetic Surgery: Procedures primarily for aesthetic purposes are excluded. If cosmetic surgery is medically necessary following an injury or illness (e.g., breast reconstruction after a mastectomy), it might be covered.

- Drug and Alcohol Abuse: Treatment for addiction or conditions arising from substance abuse.

- Organ Transplants: These are often excluded or have very specific, limited cover.

- Self-Inflicted Injuries: Injuries sustained through intentional self-harm.

- Overseas Treatment: Policies are usually designed for treatment received within the UK. If you plan to seek treatment abroad, you would need specific international health insurance.

- Experimental or Unproven Treatments: Any treatment not recognised or approved by the wider medical community.

- HIV/AIDS Related Conditions: Unfortunately, these are still commonly excluded.

- Learning Difficulties and Developmental Problems: Treatment for these conditions is generally not covered.

- Elective Treatments without Medical Necessity: For example, general health check-ups (unless specifically offered as a benefit), non-medically necessary circumcisions, or procedures not deemed necessary by a medical professional.

- Home Nursing or Long-Term Care: Unless specifically included as an add-on, general long-term care or nursing home fees are excluded.

Specific Exclusions

Beyond these standard exclusions, your policy might have specific exclusions applied during the underwriting process (especially with Full Medical Underwriting). For example, if you declared a history of recurring shoulder pain, the insurer might explicitly exclude any future claims related to your shoulder.

The Importance of Reading the Small Print

It cannot be stressed enough: always read the policy wording, terms, and conditions in full. This document is the definitive guide to your cover. Don't rely solely on a summary or what a salesperson tells you. Pay particular attention to:

- Definitions: How the insurer defines "acute," "chronic," and "pre-existing" conditions.

- Claim Process: What steps you need to take before receiving treatment (e.g., pre-authorisation).

- Limits: Monetary limits, limits on the number of sessions, or time limits for certain treatments.

- Conditions for Cover: What triggers coverage (e.g., GP referral).

Understanding the exclusions is critical to managing your expectations and avoiding costly surprises.

Step 5: Comparing Quotes – Beyond Just the Price Tag

Now that you understand the different components of a policy and what typically isn't covered, you're ready to start comparing quotes. This is where many people fall into the trap of simply choosing the cheapest option. Resist this urge! The lowest premium often means the most restrictive cover.

The Trap of "Cheapest is Best"

A policy with a low premium might have:

- A very high excess.

- A restrictive hospital list that doesn't include your preferred facilities.

- No out-patient cover, meaning you pay for all diagnostic tests and consultations yourself.

- Limited or no cover for mental health or therapies.

- An unfavourable underwriting method for your specific circumstances.

While price is undoubtedly a factor, it should be considered alongside the value and suitability of the cover.

Key Metrics for Comparison

When you receive quotes, go beyond the headline premium and compare these critical elements:

- Premium: The monthly or annual cost. Understand if it's fixed for a period or subject to annual review.

- Excess: The amount you pay per claim or per policy year. A higher excess means a lower premium, but be sure you can comfortably afford it if you need to claim.

- Underwriting Method: Is it Moratorium or Full Medical Underwriting? This is crucial for understanding how existing conditions will be handled.

- Hospital List: Does it include your preferred hospitals or hospitals convenient for you? Compare the specific hospitals listed for each policy.

- Out-patient Cover: Is it full, limited (with a specific monetary cap), or non-existent? If limited, is the cap sufficient for your potential needs?

- Specific Add-ons: If mental health, physiotherapy, or dental/optical are important, ensure they are included and check their specific limits and terms.

- No Claims Discount (NCD): Understand the NCD scale and whether NCD protection is available and worthwhile for you.

- Customer Service and Claims Reputation: Research the insurer's reputation. Look at independent reviews (e.g., on Trustpilot, Defaqto) regarding their claims process, customer support, and speed of service. A great policy on paper is useless if the claims experience is a nightmare.

- Policy Wording Clarity: While all policy wordings are dense, some are clearer and easier to understand than others.

- Annual Renewal Terms: Understand how premiums are likely to change at renewal based on age, claims, and medical inflation.

Using Comparison Websites vs. Brokers

You have two main avenues for obtaining quotes:

Comparison Websites

- Pros: Quick and easy to get multiple quotes side-by-side based on basic criteria. Good for an initial premium overview.

- Cons: Often don't delve into the nuanced differences between policies. They might not ask enough detailed questions to recommend the most suitable policy for your specific medical history or preferences. They typically focus on price over true value. You might end up comparing apples and oranges without realising it, as different policies might have different levels of cover for the same premium.

Specialist Brokers (Like WeCovr)

- Pros:

- Personalised Advice: A good broker takes the time to understand your unique needs, budget, and medical history in detail.

- Market Expertise: They have in-depth knowledge of policies from all major UK insurers, including their specific terms, exclusions, and underwriting quirks.

- Comprehensive Comparison: They can compare policies on a like-for-like basis, explaining the differences in cover, not just price.

- Time-Saving: They do the legwork of researching and obtaining quotes for you.

- Navigating Complexity: They can help you understand the small print, identify potential pitfalls, and guide you through the underwriting process.

- Advocacy: In some cases, they can act as an advocate if you have issues with a claim.

- Cost-Free Service: This is a significant advantage. At WeCovr, we pride ourselves on being that trusted partner for our clients. We work with all major UK insurers and our service is completely free to you. We are paid a commission by the insurer once a policy is taken out, meaning you get expert, impartial advice without incurring any direct cost. We have no incentive to recommend one insurer over another, only to find the best fit for you.

When comparing, it's often wise to use a combination: get a quick initial overview from a comparison site, then engage with a specialist broker to refine your options and ensure you're making a truly informed decision tailored to your specific circumstances.

Step 6: The Application Process and What to Expect

Once you've chosen a policy, the application process is the next step. Being prepared and truthful at this stage is paramount.

Gathering Information

You'll need to provide:

- Personal Details: Name, date of birth, address, contact information for all applicants.

- Medical History: This is particularly detailed for Full Medical Underwriting (FMU). Be ready to provide dates, diagnoses, treatments, and current medications for any past or present conditions. Even for Moratorium, while no upfront questionnaire is typical, the insurer will still collect basic details and implicitly rely on your medical history if a claim arises.

- Existing Policy Details (if switching): If you're moving from another insurer, have your old policy number and details ready, especially if pursuing Continued Personal Medical Exclusions (CPME).

The Medical Questionnaire (for FMU)

- Be Honest and Thorough: This cannot be stressed enough. Insurers rely on the information you provide to assess your risk. Any omissions, inaccuracies, or untruths – even unintentional ones – can lead to your policy being declared void and claims being denied, even years down the line. If in doubt, declare it.

- Seek Clarification: If a question is unclear, ask your broker or the insurer for clarification.

What Happens Next?

- Application Submission: You or your broker submit the application to the insurer.

- Review and Assessment: The insurer reviews your application. For FMU, they may request further medical information from your GP (with your consent) or ask for a medical examination.

- Policy Offer: If accepted, the insurer will send you a policy offer. This will detail the premium, the chosen cover, and, importantly, any specific exclusions that apply to your policy (e.g., excluding a pre-existing knee condition).

- Cooling-Off Period: You will typically have a 14-day or 30-day "cooling-off period" from the day you receive your policy documents. During this time, you can review the policy wording and cancel for a full refund if you change your mind.

When to Start Your Policy

Consider your existing cover if you have any. It's wise to ensure your new policy is active before cancelling any existing cover to avoid any gaps.

Switching Providers

Many people switch health insurance providers at renewal, often to seek a better deal or improved cover.

- Continued Personal Medical Exclusions (CPME): As mentioned, this is a vital aspect of switching. If you've been insured for a while and have conditions that became covered under your old policy (either via FMU or by passing the moratorium period), CPME allows your new insurer to honour that coverage. This means those conditions won't suddenly become "pre-existing" to your new policy and excluded again. Always discuss CPME with your broker if you're switching.

- New Underwriting: If you don't use CPME, or if your previous policy wasn't suitable for transfer, your new policy will be underwritten from scratch (either FMU or Moratorium), meaning all your medical history will be reassessed.

Switching can be beneficial, but it needs careful consideration to ensure you don't inadvertently lose cover for conditions that were previously active on your old policy. Your broker will be invaluable here.

Real-Life Scenarios and Common Pitfalls to Avoid

Understanding the theory is one thing; seeing how it plays out in real life and avoiding common mistakes is another.

Scenario 1: The "Pre-existing Condition" Shock

- Situation: Sarah takes out a moratorium policy. Five years ago, she had occasional lower back pain but didn't mention it as it was minor. Six months into her new policy, her back pain flares up significantly, and her GP refers her to a private orthopaedic consultant.

- Outcome: Sarah makes a claim. The insurer investigates and finds records of her previous back pain. Since it occurred within the 5-year look-back period before her policy started, and she had not had 2 continuous symptom-free years since her policy began, the claim is denied as a pre-existing condition.

- Lesson: Moratorium policies require a full 2 years symptom-free from policy inception for pre-existing conditions to become covered. All conditions within the "look-back" period (usually 5 years) are considered pre-existing until proven otherwise.

Scenario 2: The Limited Out-patient Cover

- Situation: David takes out a policy with a £1,000 out-patient limit to keep premiums low. He develops persistent headaches. His GP refers him for an MRI scan (£700) and then two follow-up consultations with a neurologist (£250 each).

- Outcome: The MRI and the first consultation are covered. However, after the first consultation, David has spent £950 of his £1,000 limit. The second consultation (£250) is only covered for £50, and David has to pay the remaining £200 out of pocket. If further diagnostic tests are needed, he'd pay for those entirely himself.

- Lesson: Understand the limits on your out-patient cover. Diagnostic pathways can quickly exceed seemingly generous limits.

Scenario 3: The Hospital List Misunderstanding

- Situation: Emily chooses a policy with a restricted hospital list to save money, assuming it will cover "all major hospitals." When she needs a knee operation, her preferred private hospital in central London is not on her policy's list.

- Outcome: Emily has to either travel further to a hospital on her approved list or pay the full cost of treatment at her preferred, excluded hospital.

- Lesson: Always check the specific hospital list of your chosen policy to ensure your preferred or local convenient hospitals are included.

Scenario 4: Not Understanding Underwriting Method

- Situation: Mark switches insurers after 3 years, choosing a new Moratorium policy, without understanding CPME. On his old policy, a historical bowel condition had become covered after a symptom-free period.

- Outcome: Mark experiences a flare-up of his bowel condition within 6 months of his new policy. Because he took a new Moratorium policy and didn't transfer his medical history with CPME, his bowel condition is treated as a new pre-existing condition to the new policy and is excluded, despite having been covered by his previous insurer.

- Lesson: Always discuss CPME with your broker when switching, especially if you have conditions that became covered under your previous policy.

Pitfalls to Avoid

- Lying or Omitting Information on Your Application: This is the quickest way to invalidate your policy. Be completely honest and thorough.

- Not Reading the Policy Wording: Never assume cover. The definitive terms are in the full policy document.

- Solely Focusing on Price: The cheapest policy is rarely the most suitable. It can lead to significant out-of-pocket expenses or a lack of cover when you need it most.

- Ignoring Reviews and Customer Service: A difficult claims process or unresponsive customer service can add immense stress when you're unwell. Check independent reviews.

- Forgetting Annual Reviews: Your needs, the market, and your insurer's terms can change. Review your policy annually to ensure it's still fit for purpose.

By learning from these scenarios and actively avoiding these pitfalls, you can significantly improve your experience with private health insurance.

The Role of a Specialist Broker (Like WeCovr)

Given the complexities outlined in this guide, the value of a specialist private health insurance broker becomes incredibly clear. While comparison websites offer a superficial glance, a broker provides depth, expertise, and personalised guidance.

Why Use a Broker?

- Impartial Advice Across the Market: Unlike individual insurers who can only sell their own products, a broker works with all major UK health insurance providers. This means they can offer impartial advice and recommend the best policy from the entire market, tailored to your specific needs.

- Deep Understanding of Policy Nuances: Brokers spend their days immersed in policy wordings, underwriting rules, and exclusion lists. They understand the subtle but critical differences between policies that can be easily missed by a layperson. They know, for example, which insurers are more lenient on certain conditions or have better mental health cover.

- Save You Time and Effort: Instead of you spending hours researching and comparing, a broker does the hard work for you. They gather quotes, summarise the key differences, and present you with a shortlist of suitable options.

- Help You Navigate Exclusions and Fine Print: They can explain complex terms like "moratorium" or "CPME" in plain English, ensuring you fully understand what is and isn't covered. They'll also help you fill out application forms correctly to avoid issues later.

- Advocacy During Claims (Sometimes): While not all brokers directly manage claims, many offer support and advice if you encounter difficulties with your insurer during the claims process.

- Crucially: It's a Free Service to You! This is perhaps the biggest surprise and benefit for many. Specialist health insurance brokers in the UK are remunerated by the insurers through a commission once a policy is taken out. This means you receive expert, tailored advice and support at absolutely no direct cost to you. The premium you pay through a broker is the same as if you went directly to the insurer.

At WeCovr, we pride ourselves on being that trusted partner. We are a modern, expert UK health insurance broker. We understand that navigating the private healthcare market can be daunting, and our mission is to simplify it for you. We work tirelessly with all major UK insurers, using our expertise to:

- Thoroughly assess your individual or family's healthcare needs and budget.

- Source the most suitable policies from across the entire market.

- Clearly explain the pros and cons of different options, including crucial details like underwriting methods and exclusions.

- Guide you through the application process, ensuring accuracy and honesty.

- Help you secure the best possible coverage at no cost to you.

Choosing the right private health insurance policy is a significant decision. With a specialist broker like us by your side, you gain invaluable expertise, save time, and ensure you make an informed choice that truly protects your health and financial well-being.

Maintaining and Reviewing Your Policy

Taking out a policy isn't the end of the journey; it's an ongoing relationship. To ensure your private health insurance continues to serve your needs effectively, regular review and understanding of the claims process are vital.

Annual Review

Your policy will renew annually, and this is a critical time to review your cover:

- Your Needs Change: Has your family situation changed? Do you have new health concerns (remembering pre-existing exclusions apply)? Are you now in a position to afford more comprehensive cover, or do you need to reduce costs?

- Insurer Terms/Premiums Change: Insurers will adjust premiums annually based on your age, claims history (NCD), medical inflation, and their overall book of business. They may also alter policy terms or add/remove benefits.

- NCD Impact: Review your No Claims Discount level and understand how any claims you made have affected your premium.

- Market Comparison: It's a good time to re-evaluate what's available in the wider market. A policy that was competitive last year might not be this year.

Renewal vs. Switching

- Renewal: Often, it's easier to simply renew with your existing insurer. Some insurers offer loyalty benefits. However, don't assume that renewal is always the best value.

- Switching: As discussed, switching can often secure a better premium or more suitable cover, especially if your needs have changed or if new, more competitive products have emerged. If switching, remember the importance of Continued Personal Medical Exclusions (CPME) to maintain cover for conditions that became covered under your previous policy. Your broker will guide you through this complex aspect.

Making a Claim

Understanding the claims process before you need it is crucial:

- GP Referral: In most cases, you'll need to see your NHS GP first for a diagnosis and a referral to a private specialist. Your policy won't cover GP fees.

- Pre-authorisation is Key: Before seeing a specialist or undergoing any diagnostic tests or treatment, always contact your insurer for pre-authorisation. They will confirm if the condition and proposed treatment are covered under your policy and provide an authorisation code. Proceeding without pre-authorisation can lead to your claim being denied.

- Consultant and Hospital Choice: Ensure the consultant and hospital are on your policy's approved list.

- Submitting Invoices: After treatment, you or the hospital will send the invoices directly to your insurer. For out-patient treatments or therapies, you might pay upfront and then claim reimbursement.

- Excess Application: Remember your excess. You will typically pay this directly to the hospital or consultant, or it will be deducted from the insurer's payment.

A smooth claims process relies heavily on following your insurer's specific procedures and obtaining pre-authorisation for all stages of your treatment.

The Future of UK Private Health Insurance

The landscape of UK private health insurance is not static. Several trends are shaping its future:

- Technology and Digital Health: Insurers are increasingly integrating digital GP services, virtual consultations, and health apps into their offerings. Wearable technology could also play a greater role in personalised risk assessment and preventative care.

- Personalised Plans: Expect more flexibility and customisation, allowing individuals to tailor their policies even more precisely to their specific health risks and lifestyle.

- Focus on Preventative Care and Well-being: There's a growing shift towards encouraging policyholders to maintain good health and prevent illness, not just treat it. This can manifest through incentives, health assessments, and wellbeing programmes.

- Integration with Mental Health: As mental health awareness continues to grow, expect more comprehensive and integrated mental health support within policies.

- NHS Collaboration: As pressures on the NHS grow, there might be further exploration of how private and public sectors can collaborate more effectively to manage patient flows and optimise care pathways.

These developments promise a more dynamic and potentially more user-centric private health insurance experience in the years to come.

Conclusion: Empowering Your Healthcare Choices

Navigating the world of UK private health insurance can undoubtedly seem overwhelming at first. From deciphering underwriting methods to understanding the nuances of inclusions and exclusions, it's a field fraught with complexity. However, by taking a methodical, step-by-step approach, you can move "beyond the brochure" and make an informed decision that genuinely serves your healthcare needs.

This guide has equipped you with the essential knowledge: the difference between acute and chronic conditions, the critical role of underwriting methods like moratorium and full medical underwriting, the importance of understanding policy limits and exclusions, and the strategic value of an annual review.

Remember, the cheapest policy is rarely the best policy. True value lies in a policy that offers suitable cover for your specific circumstances, a manageable excess, and a reputable insurer known for good customer service.

Ultimately, your health is one of your most precious assets. Investing in private health insurance can provide invaluable peace of mind, faster access to treatment, and greater choice over your care. Don't leave such an important decision to chance or a quick comparison search. Take control, ask the right questions, and leverage expert advice.

At WeCovr, we are here to empower your healthcare choices. We invite you to use our expertise to cut through the complexity. Let us help you compare policies from all major UK insurers, ensuring you find the most suitable coverage for your needs, all at absolutely no cost to you. Because when it comes to your health, you deserve clarity, confidence, and the very best support. Your health is an investment, not an expense.

Related guides

Why private medical insurance and how does it work?

What is Private Medical Insurance?

Private medical insurance (PMI) is a type of health insurance that provides access to private healthcare services in the UK. It covers the cost of private medical treatment, allowing you to bypass NHS waiting lists and receive faster, more convenient care.How does it work?

Private medical insurance works by paying for your private healthcare costs. When you need treatment, you can choose to go private and your insurance will cover the costs, subject to your policy terms and conditions. This can include:• Private consultations with specialists

• Private hospital treatment and surgery

• Diagnostic tests and scans

• Physiotherapy and rehabilitation

• Mental health treatment

Your premium depends on factors like your age, health, occupation, and the level of cover you choose. Most policies offer different levels of cover, from basic to comprehensive, allowing you to tailor the policy to your needs and budget.

Questions to ask yourself regarding private medical insurance

Just ask yourself:👉 Are you concerned about NHS waiting times for treatment?

👉 Would you prefer to choose your own consultant and hospital?

👉 Do you want faster access to diagnostic tests and scans?

👉 Would you like private hospital accommodation and better food?

👉 Do you want to avoid the stress of NHS waiting lists?

Many people don't realise that private medical insurance is more affordable than they think, especially when you consider the value of faster treatment and better facilities. A great insurance policy can provide peace of mind and ensure you receive the care you need when you need it.

Benefits offered by private medical insurance

Private medical insurance provides numerous benefits that can significantly improve your healthcare experience and outcomes:Faster Access to Treatment

One of the biggest advantages is avoiding NHS waiting lists. While the NHS provides excellent care, waiting times can be lengthy. With private medical insurance, you can often receive treatment within days or weeks rather than months.

Choice of Consultant and Hospital

You can choose your preferred consultant and hospital, giving you more control over your healthcare journey. This is particularly important for complex treatments where you want a specific specialist.

Better Facilities and Accommodation

Private hospitals typically offer superior facilities, including private rooms, better food, and more comfortable surroundings. This can make your recovery more pleasant and potentially faster.

Advanced Treatments

Private medical insurance often covers treatments and medications not available on the NHS, giving you access to the latest medical advances and technologies.

Mental Health Support

Many policies include comprehensive mental health coverage, providing faster access to therapy and psychiatric care when needed.

Tax Benefits for Business Owners

If you're self-employed or a business owner, private medical insurance premiums can be tax-deductible, making it a cost-effective way to protect your health and your business.

Peace of Mind

Knowing you have access to private healthcare when you need it provides invaluable peace of mind, especially for those with ongoing health conditions or concerns about NHS capacity.

Private medical insurance is particularly valuable for those who want to take control of their healthcare journey and ensure they receive the best possible treatment when they need it most.

Important Fact!

We can look at a more suitable option mid-term!

Why is it important to get private medical insurance early?

👉 Many people are very thankful that they had their private medical insurance cover in place before running into some serious health issues. Private medical insurance is as important as life insurance for protecting your family's finances.👉 We insure our cars, houses, and even our phones! Yet our health is the most precious thing we have.

Easily one of the most important insurance purchases an individual or family can make in their lifetime, the decision to buy private medical insurance can be made much simpler with the help of FCA-authorised advisers. They are the specialists who do the searching and analysis helping people choose between various types of private medical insurance policies available in the market, including different levels of cover and policy types most suitable to the client's individual circumstances.

It certainly won't do any harm if you speak with one of our experienced insurance experts who are passionate about advising people on financial matters related to private medical insurance and are keen to provide you with a free consultation.

You can discuss with them in detail what affordable private medical insurance plan for the necessary peace of mind they would recommend! WeCovr works with some of the best advisers in the market.

By tapping the button below, you can book a free call with them in less than 30 seconds right now:

Our Group Is Proud To Have Issued 900,000+ Policies!

We've established collaboration agreements with leading insurance groups to create tailored coverage

How It Works

1. Complete a brief form

2. Our experts analyse your information and find you best quotes

3. Enjoy your protection!

Any questions?

Learn more

Who Are WeCovr?

WeCovr is an insurance specialist for people valuing their peace of mind and a great service.👍 WeCovr will help you get your private medical insurance, life insurance, critical illness insurance and others in no time thanks to our wonderful super-friendly experts ready to assist you every step of the way.

Just a quick and simple form and an easy conversation with one of our experts and your valuable insurance policy is in place for that needed peace of mind!