The Ultimate Guide to Life Insurance in the UK: Top 10 Providers for 2026

The Ultimate Guide to Life Insurance in the UK: Top 10 Providers for 2026

Life insurance stands as one of the most critical financial protections available to UK families, yet alarmingly, over 70% of British households lack adequate cover. The UK life insurance market, valued at £37 billion in 2024, is experiencing robust growth, with protection insurers paying out a record £7.34 billion to support individuals and families in 2023. This comprehensive guide provides an authoritative examination of the top 10 life insurance providers in the UK, delivering detailed analysis of their products, pricing structures, and performance metrics to help you make an informed decision about protecting your family's financial future.

When selecting life insurance, working with a specialist broker like WeCovr can simplify the process and ensure you access the most suitable policies from leading insurers across the market.

Understanding Life Insurance in the UK

Life insurance provides a tax-free lump sum payment to your beneficiaries if you die during the policy term. In the UK, this financial protection serves multiple critical purposes:

- Mortgage Protection: Clear outstanding mortgage debts to secure your family's home

- Debt Coverage: Pay off personal loans, credit cards, and other financial obligations

- Income Replacement: Provide ongoing financial support to maintain living standards

- Education Funding: Secure children's educational expenses and future opportunities

- Funeral Expenses: Cover funeral costs, which average £4,000-£7,000 in the UK

- Inheritance Tax: Help beneficiaries manage potential tax liabilities

The average cost of life insurance in the UK is £32.64 per month, with basic cover starting from as little as £3.52 monthly for younger applicants. Most importantly, 98.3% of all life insurance claims are paid out, demonstrating the exceptional reliability of this protection.

Types of Life Insurance Available in the UK

Term Life Insurance

Level Term Life Insurance maintains a fixed payout amount throughout the policy term. If you die during the term, your beneficiaries receive the full sum assured. This represents the most popular type of life insurance in the UK, offering predictable premiums and guaranteed coverage amounts.

Decreasing Term Life Insurance reduces the payout amount over time, typically aligning with a repayment mortgage balance. Monthly premiums remain fixed but are generally lower than level term policies, making this ideal for mortgage protection.

Increasing Term Life Insurance includes annual increases to the payout amount to combat inflation, typically rising by 3%, 5%, or in line with the Retail Price Index. This ensures your family's protection maintains its real value over time.

Family Income Benefit pays a regular monthly income to your family instead of a lump sum, providing ongoing financial support throughout the remaining policy term. This can feel more manageable for families and helps maintain household budgeting structures.

Whole of Life Insurance

Unlike term insurance, whole of life policies guarantee a payout whenever you die, provided premiums are maintained. In the UK, most modern whole of life plans are straightforward protection products without any investment element or cash value. Because the cover lasts for life, premiums are higher than for term insurance. Whole of life cover is often used for inheritance tax planning or to leave a guaranteed gift to your beneficiaries.

Over 50s Life Insurance

Available to UK residents aged 50-80, these policies guarantee acceptance without medical questions. Cover is typically limited to £10,000-£25,000 and is designed to cover funeral costs and small debts. While convenient, they often provide poor value compared to underwritten policies.

The Top 10 Life Insurance Providers in the UK (2026)

Based on comprehensive analysis of expert ratings, customer satisfaction scores, claims payout rates, and product offerings, here are the definitive top 10 life insurance providers in the UK for 2025:

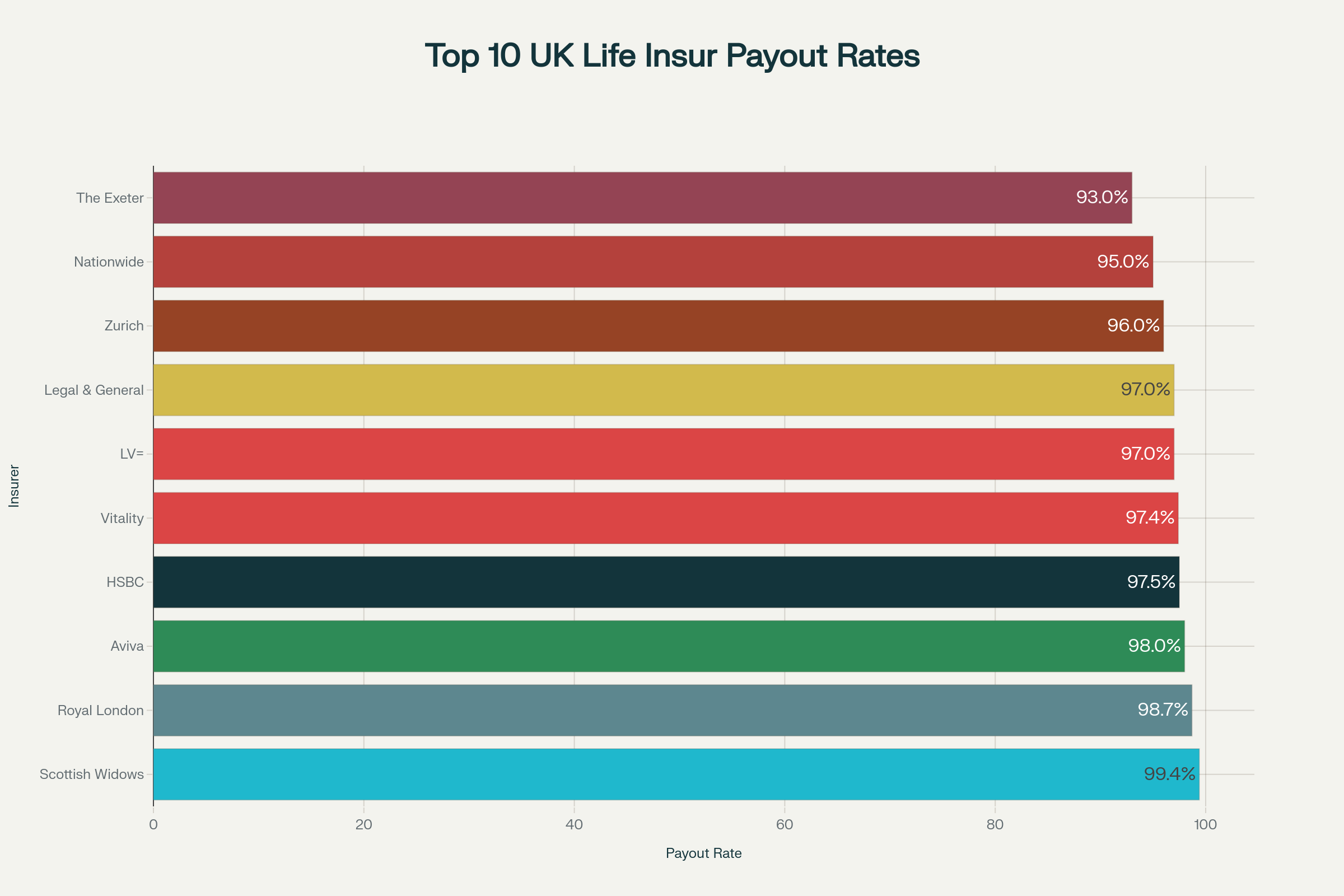

UK Life Insurance Providers by Claims Payout Rate (2025)

1. Vitality (Expert Rating: 5.0★)

Performance Metrics:

- Claims payout rate: 97.4%

- Trustpilot rating: 4.4/5

- Minimum monthly premium: £9.13

- Maximum cover: £10 million

Revolutionary Health Rewards Programme: Vitality transformed UK life insurance by introducing dynamic pricing linked to health and wellness behaviours. Policyholders can earn rewards and premium discounts of up to 25% by maintaining healthy lifestyles through their comprehensive tracking system. The programme includes gym memberships, healthy food discounts, and travel benefits.

Product Portfolio:

- Level and decreasing term life insurance

- Comprehensive critical illness cover (114-174 conditions depending on tier)

- Family income benefit

- Over 50s life cover

Premium Examples (Non-Smoker, Good Health):

- 30-year-old: £9.13/month for £300,000 level term over 20 years

- 40-year-old: £16.98/month for £300,000 level term over 20 years

- 50-year-old: £41.21/month for £300,000 level term over 20 years

The dynamic pricing model means premiums can decrease for active members (achieving Gold or Platinum status) while potentially increasing for inactive members, making this ideal for health-conscious individuals.

2. Aviva (Expert Rating: 5.0★)

Performance Metrics:

- Claims payout rate: 98.0%

- Trustpilot rating: 4.3/5

- Minimum monthly premium: £11.50

- Maximum cover: £3 million (£2 million with Total Permanent Disability)

Heritage and Innovation: Founded in 1696, Aviva represents 329 years of insurance expertise, serving over 15 million customers across the UK. The company successfully balances traditional insurance values with modern digital innovation through their Aviva DigiCare+ platform.

Digital Health Services: Aviva DigiCare+ provides comprehensive wellness support including:

- Unlimited access to fitness facilities

- Annual health assessments

- 24/7 telephone health helplines

- Mental health support services

- Nutritional guidance

Product Range:

- Level, decreasing, and increasing term life insurance

- Comprehensive critical illness cover

- Whole of life insurance

- Over 50s life insurance with guaranteed acceptance

- Family income benefit

Unique Benefits:

- Life Change Benefit allows cover increases without medical underwriting for qualifying life events (marriage, birth, mortgage increase)

- Two months free cover available for new customers

- Children's critical illness cover included automatically

- Terminal illness cover as standard

3. Scottish Widows (Expert Rating: 5.0★)

Performance Metrics:

- Claims payout rate: 99.4% (industry-leading)

- Trustpilot rating: 4.5/5

- Minimum monthly premium: £20.00

- Maximum cover: £25 million

Industry-Leading Claims Performance: Scottish Widows maintains the highest claims payout rate in the UK life insurance market at 99.4%, having paid out £243 million in claims during 2023. This exceptional performance reflects their commitment to supporting customers when they need it most.

Heritage and Care Services: With nearly 200 years of experience protecting UK families since 1815, Scottish Widows provides the Scottish Widows Care service in partnership with RedArc. This offers practical advice and emotional support from qualified nurses, available from day one of your policy.

Comprehensive Product Portfolio:

- Level and decreasing term life insurance

- Critical illness cover (30 main conditions plus 10 additional conditions)

- Family income benefit

- Whole of life insurance

Standout Features:

- Free terminal illness benefit with 12-month life expectancy criterion

- Free accidental death cover during application processing (up to 90 days)

- Policy splitting option for joint policies if relationships end

- Comprehensive care support services through qualified nursing staff

4. LV= (Expert Rating: 5.0★)

Performance Metrics:

- Claims payout rate: 97.0%

- Trustpilot rating: 4.5/5

- Minimum monthly premium: £5.00

- Maximum cover: £10 million

Mutual Advantage: As a mutual organisation, LV= is owned by its members rather than external shareholders. This structure allows the company to focus entirely on customer service and value rather than profit maximisation for external investors.

Member Benefits Programme: LV= membership provides extensive additional benefits:

- Discounts on car, home, pet, and travel insurance products

- 24-hour member care line for legal and health queries

- Access to tradesman networks for emergencies

- Financial planning support

Product Portfolio:

- Level and decreasing term life insurance

- Critical illness cover

- Family income benefit

- Over 50s life insurance

- Relevant life cover for businesses

Healthcare Services: LV= Doctor Services provides fast access to medical advice including remote GP consultations, second medical opinions, and mental health support at no additional cost.

5. Legal & General (Expert Rating: 5.0★)

Performance Metrics:

- Claims payout rate: 97.0%

- Trustpilot rating: 4.2/5

- Average monthly premium: £27.95

- Maximum cover: Unlimited

Market Leadership: Legal & General holds the position as the UK's largest provider of term life insurance and has been crowned 'Life Insurance Provider of the Year (Direct)' for five consecutive years. In 2023, the company paid out £519 million in life insurance claims with an average payout of £39,916.

Financial Strength: As one of the UK's largest financial services companies, Legal & General provides exceptional financial security and stability for policyholders, with assets under management exceeding £1.3 trillion.

Product Range:

- Level, decreasing, and increasing term life insurance

- Comprehensive critical illness cover

- Family income benefit

- Whole of life insurance

- Over 50s life insurance

Unique Features:

- £10,000 funeral pledge providing immediate payment upon claim acceptance

- Market-leading underwriting expertise for complex cases

- Strong digital platform for applications and policy management

- Comprehensive support throughout the claims process

6. Zurich (Expert Rating: 4.5★)

Performance Metrics:

- Claims payout rate: 96.0%

- Trustpilot rating: 3.7/5

- Minimum monthly premium: £5.00

- Maximum cover: £10 million

Global Expertise: Founded in 1872, Zurich represents one of the world's largest insurance companies, providing global expertise and exceptional financial strength. The company's international experience benefits UK customers through sophisticated risk assessment and product development.

Innovative Protection Features: Zurich offers unique additional benefits including:

- Multi-fracture cover providing up to £6,000 for bone breaks, dislocations, and ligament tears

- Children's benefit covering up to £25,000 for critical illness diagnosis

- Separation benefit allowing joint policies to split into individual policies following divorce

Product Portfolio:

- Level, decreasing, and increasing term life insurance

- Critical illness cover (39 specified conditions)

- Children's cover

- Multi-fracture cover

Operational Benefits:

- Free life cover during underwriting process (up to £2 million)

- Global financial stability and strength

- Comprehensive online policy management

- Flexible premium payment options

7. Royal London (Expert Rating: 4.5★)

Performance Metrics:

- Claims payout rate: 98.7%

- Trustpilot rating: 4.6/5 (highest among major providers)

- Minimum monthly premium: £7.00

- Maximum cover: Unlimited

Record Claims Performance: Royal London paid out over £751 million in protection claims during 2024, supporting 65,385 families and businesses when they needed it most. This represents their highest ever annual payout, demonstrating their commitment to customer support.

Mutual Structure: As the UK's largest mutual life, pensions, and investment company, Royal London is owned by its members rather than shareholders. This ensures all profits are reinvested into better services and competitive pricing for customers.

Specialist Products:

- Level and decreasing term life insurance

- Family income benefit (Royal London's specialty)

- Critical illness cover

- Whole of life insurance

- Specialist diabetes life cover with annual HbA1c monitoring rewards

Innovation in Family Income Benefit: Royal London pioneered family income benefit products in the UK, offering expertise in policies that pay regular monthly income rather than lump sums. This can provide more consistent financial support for grieving families.

8. HSBC (Expert Rating: 4.5★)

Performance Metrics:

- Claims payout rate: 97.5%

- Trustpilot rating: 4.0/5

- Minimum monthly premium: £4.25

- Maximum cover: £1 million

Banking Integration: HSBC Life leverages the strength and convenience of one of the world's largest banking groups. Existing HSBC customers benefit from integrated financial services and streamlined application processes.

Competitive Pricing: HSBC offers some of the most competitive entry-level pricing in the market, with basic life insurance available from just £4.25 monthly. This makes protection accessible to younger families and those on tighter budgets.

Product Range:

- Level and decreasing term life insurance

- Critical illness cover (36 specified conditions)

- Income protection

- Joint life policies

Additional Services:

- HSBC Life Online Health Services providing second medical opinions

- Free house purchase cover for mortgage applications (up to 90 days)

- Terminal illness benefit included as standard

- Guaranteed insurability options for major life events

9. The Exeter (Expert Rating: 4.5★)

Performance Metrics:

- Claims payout rate: 93.0%

- Trustpilot rating: 4.2/5

- Minimum monthly premium: £15.00

- Maximum cover: £1 million

Specialist Medical Conditions Expertise: The Exeter fills a crucial gap in the UK market by specialising in life insurance for people with pre-existing medical conditions who might struggle to obtain cover elsewhere. Their 'Real Life' product caters specifically to non-standard health risks.

Covered Medical Conditions: The Exeter provides cover for conditions typically excluded or heavily loaded by mainstream insurers:

- Diabetes (Type 1 and Type 2)

- Heart conditions and previous heart attacks

- Cancer survivors

- Mental health conditions

- Stroke survivors

- Autoimmune disorders

Mutual Society Benefits: As a mutual society with no shareholders, The Exeter reinvests all profits into better services and competitive pricing for members. This structure aligns perfectly with their mission to serve people often underserved by mainstream insurers.

Health Support Services: All policyholders receive access to the HealthWise app providing:

- 24/7 GP consultations

- Mental health support

- Physiotherapy services

- Second medical opinions

10. Nationwide (Expert Rating: 4.0★)

Performance Metrics:

- Claims payout rate: 95.0%

- Trustpilot rating: 4.8/5 (highest customer satisfaction)

- Minimum monthly premium: £6.00

- Maximum cover: £750,000

Building Society Heritage: As the world's largest building society with 15 million members, Nationwide brings a mutual ethos to life insurance provision. The society's life insurance is provided through Legal & General, combining Nationwide's customer service excellence with Legal & General's insurance expertise.

Exceptional Customer Satisfaction: Nationwide achieves the highest customer satisfaction rating at 4.8/5, reflecting their commitment to member service and the building society principle of putting members before profits.

Product Portfolio:

- Level and decreasing term life insurance

- Critical illness cover

- Over 50s life insurance with guaranteed acceptance

Member Benefits:

- Building society mutual benefits and member ownership

- Integration with Nationwide's broader financial services

- Guaranteed acceptance over 50s plans requiring no medical questions

- Competitive pricing through Legal & General partnership

Specialist brokers like WeCovr can help identify which of these providers offers the most suitable terms for your specific circumstances, potentially saving significant amounts on premiums while ensuring comprehensive coverage.

Comprehensive Cost Analysis and Premium Factors

UK Life Insurance Premium Costs by Age and Policy Type (2025)

Life insurance premiums in the UK vary dramatically based on multiple risk factors, with costs increasing exponentially with age and differing significantly between smokers and non-smokers.

Age Impact on Premium Costs

For a standard £150,000 level term policy over 20 years, monthly premiums demonstrate clear age-related increases:

| Age | Level Term (Non-Smoker) | Level Term (Smoker) | Decreasing Term (Non-Smoker) | Decreasing Term (Smoker) |

|---|---|---|---|---|

| 25 | £4.62 | £8.50 | £3.80 | £7.20 |

| 30 | £5.76 | £10.20 | £4.90 | £8.90 |

| 35 | £8.21 | £14.80 | £6.80 | £12.40 |

| 40 | £11.33 | £20.50 | £9.50 | £17.80 |

| 45 | £16.74 | £28.90 | £14.20 | £24.50 |

| 50 | £27.60 | £42.30 | £23.10 | £36.80 |

Critical Premium Factors

Smoking Status Impact: Smokers pay approximately 80-85% more than non-smokers due to significantly elevated health risks. Even social or occasional smoking affects pricing.

Health and Medical History: Conditions like diabetes, heart disease, cancer history, or mental health issues can increase premiums or require specialist insurers. The Exeter specifically caters to such circumstances.

Occupational Risk: High-risk occupations including pilots, offshore workers, military personnel, or emergency services may face premium loadings or specific exclusions.

Lifestyle Factors: Participation in extreme sports, excessive alcohol consumption, dangerous hobbies, or frequent international travel to high-risk countries affects pricing.

Coverage Amount: Higher coverage amounts require more detailed financial and medical underwriting and may increase per-pound costs due to selection effects.

Policy Term Length: Longer terms generally result in higher overall premiums but crucially lock in rates at your current age, protecting against future health deterioration.

Regional and Demographic Variations

Geographic Location: London residents don't necessarily pay the highest premiums despite higher living costs. Manchester consistently shows higher rates, while Edinburgh often offers the lowest premiums.

Gender Differences: Women typically pay slightly lower premiums than men due to longer life expectancy, though the difference has narrowed following European Union gender equality legislation.

Professional vs. Direct Purchase: Using specialist brokers can reduce costs by 10-20% through access to exclusive products and better risk placement.

Claims Performance and Industry Reliability

The UK life insurance industry maintains exceptional claims performance, with 98.3% of all protection claims paid in 2023. This reliability forms the foundation of life insurance value proposition.

Industry-Wide Performance Metrics

- Total industry payouts 2023: £7.34 billion

- Number of claims paid: Over 275,000

- Average life insurance claim: £39,916

- Critical illness claims: £1.27 billion paid

- Income protection claims: £177 million paid

Claims Decline Reasons

The small percentage of declined claims typically result from:

- Non-disclosure: Failure to reveal material medical history or lifestyle factors

- Fraud: Intentionally providing false information

- Policy lapses: Claims made after premium payments ceased

- Exclusions: Deaths resulting from excluded activities or conditions

- Suicide clause: Most policies exclude suicide within the first 12-24 months

Provider-Specific Claims Performance

- Scottish Widows: 99.4% - Industry leader

- Royal London: 98.7% - Excellent performance

- Aviva: 98.0% - Strong reliability

- HSBC: 97.5% - Above industry average

- Vitality: 97.4% - Consistent performance

Critical Illness Cover and Additional Protection

Most UK life insurance providers offer critical illness cover as an optional add-on, providing a lump sum upon diagnosis of specified serious medical conditions.

Most Common Critical Illness Claims

Based on industry data, the leading causes for critical illness claims are:

- Cancer: 64% of all claims

- Heart attack: 10% of claims

- Stroke: 9% of claims

- Multiple sclerosis: 3% of claims

- Kidney failure: 2% of claims

Industry Critical Illness Statistics

- Total claims paid 2023: £1.27 billion

- Average payout: £67,267

- Industry payout rate: 91.6%

- Most comprehensive coverage: Vitality (up to 174 conditions)

Essential Additional Benefits

Terminal Illness Cover: Provides early payout if diagnosed with less than 12 months to live, included as standard with all quality policies.

Children's Cover: Protects children (typically ages 30 days to 18 years) against critical illness at no additional cost with most providers.

Waiver of Premium: Continues your life insurance cover if you become unable to work due to illness or injury.

Guaranteed Insurability Options: Allows cover increases without medical questions following qualifying life events (marriage, birth, mortgage increase).

Making the Right Provider Choice

Essential Selection Criteria

1. Financial Strength and Stability All featured providers maintain excellent financial stability, but consider credit ratings and regulatory compliance history.

2. Claims Payout Performance Scottish Widows leads at 99.4%, but all top providers exceed 95% payout rates, well above industry standards.

3. Product Range and Flexibility Consider your current and future needs. Providers like Royal London excel in family income benefit, while The Exeter specialises in medical conditions.

4. Customer Service Excellence Nationwide achieves highest customer satisfaction (4.8/5), while others maintain strong 4.0+ ratings across Trustpilot reviews.

5. Value-Added Services Features like Vitality's health rewards, Aviva's DigiCare+, or Scottish Widows' care services can provide substantial additional value.

6. Premium Competitiveness for Your Risk Profile While cost matters, different insurers assess risks differently. The cheapest quote may not come from the obvious provider.

The Professional Broker Advantage

Working with specialist brokers like WeCovr provides crucial advantages in navigating the complex UK life insurance landscape:

- Whole-of-Market Access: Brokers access dozens of insurers, including those not available direct to consumers

- Risk Assessment Expertise: Understanding which insurers view specific risk factors most favourably

- Underwriting Knowledge: Knowing how to present applications for optimal outcomes

- Ongoing Support: Assistance with applications, claims, and policy reviews

- Cost-Free Service: Most brokers receive payment from insurers, not customers

- Market Intelligence: Access to pricing trends and product developments

Industry Trends and Future Developments

Digital Transformation Revolution

The UK life insurance industry is experiencing rapid digitalisation:

- Instant Online Applications: Many providers now offer immediate decisions for standard risks

- Health Tracking Integration: Wearables and apps increasingly influence pricing and rewards

- Digital Claims Processing: Streamlined claims handling through online portals

- Virtual Medical Consultations: Telemedicine replacing traditional medical examinations

Wellness and Prevention Focus

Following Vitality's pioneering success, the industry is embracing wellness:

- Premium Discounts: Rewards for healthy behaviours becoming standard

- Preventive Healthcare: Access to health screening and early intervention services

- Mental Health Support: Comprehensive mental health benefits increasingly included

- Lifestyle Medicine: Integration of nutrition, exercise, and stress management support

Regulatory and Market Evolution

Financial Conduct Authority Oversight: Ensuring fair treatment, transparent pricing, and robust claims handling across all providers.

Consumer Duty Implementation: New regulations requiring firms to deliver good outcomes for customers throughout the product lifecycle.

Climate Change Impact: Insurers increasingly considering environmental factors in risk assessment and product development.

Market Growth Projections

The UK life insurance market shows strong growth potential:

- Market Value 2025: Projected £219.60 billion

- Per Capita Spending: Expected £3,220 annually

- Growth Drivers: Increased protection awareness, ageing population, rising healthcare costs

Practical Implementation Guide

Step 1: Coverage Calculation

Use established methodologies to determine appropriate coverage:

- Income Replacement: 10 times annual salary

- Debt Coverage: All outstanding mortgages, loans, and credit cards

- Future Expenses: Children's education, living costs for dependents

- Specific Goals: Funeral costs, inheritance tax planning

Step 2: Policy Type Selection

Term Insurance Suitability:

- Temporary needs (mortgage protection, dependent children)

- Cost-effective protection during peak earning years

- Flexibility to adjust coverage as needs change

Whole of Life Appropriateness:

- Permanent needs (inheritance tax, funeral costs)

- Wealth transfer planning

- Charitable giving objectives

Step 3: Additional Coverage Evaluation

Consider supplementary protections based on circumstances:

- Critical Illness Cover: Essential for single-income families

- Income Protection: Protects earnings during illness or injury

- Family Income Benefit: Provides structured ongoing support

Step 4: Market Comparison Strategy

Professional Broker Engagement: Utilise specialist brokers like WeCovr for comprehensive market access and expert guidance.

Multiple Quote Comparison: Obtain quotes from at least 3-5 providers to ensure competitive pricing.

Risk Profile Optimisation: Work with brokers to present your risk profile optimally to different insurers.

Step 5: Application Best Practices

Complete Disclosure: Provide comprehensive, accurate information about health, lifestyle, and financial circumstances.

Medical Evidence Preparation: Gather relevant medical records and attend required examinations promptly.

Professional Guidance: Utilise broker expertise throughout the application process.

Step 6: Ongoing Management

Regular Reviews: Conduct annual policy reviews to ensure coverage remains appropriate.

Life Event Updates: Notify insurers of major life changes that may affect coverage needs.

Premium Monitoring: Compare market rates periodically to ensure continued competitiveness.

Common Misconceptions Addressed

"Life Insurance Is Prohibitively Expensive"

Reality: With basic cover available from £3.52 monthly and average costs of £32.64, life insurance represents exceptional value. Many people spend more on coffee or entertainment subscriptions.

"Insurance Companies Avoid Paying Claims"

Reality: UK insurers pay 98.3% of claims, totalling £7.34 billion in 2023. The industry's reputation depends on reliable claims payment.

"I'm Too Young/Healthy to Need Cover"

Reality: Youth and good health make life insurance most affordable and easiest to obtain. Delaying purchase only increases costs and complicates underwriting.

"Employer Death-in-Service Benefits Are Sufficient"

Reality: Employer benefits typically provide 2-4 times salary and end when employment terminates. Personal policies offer greater control and portability.

"Health Problems Prevent Life Insurance"

Reality: Specialist insurers like The Exeter specifically cater to non-standard health risks, often providing cover when mainstream insurers cannot.

"Single People Don't Need Life Insurance"

Reality: Life insurance can cover debts, support parents or siblings, fund charitable giving, or provide future insurability guarantees.

Conclusion: Securing Your Family's Financial Future

The UK life insurance market offers exceptional choice, competitive pricing, and reliable protection through established, financially strong providers. With claims payout rates exceeding 98% and comprehensive product ranges available, UK consumers can confidently secure their families' financial futures.

Scottish Widows leads on claims performance with industry-best 99.4% payout rates, while Vitality innovates through health rewards and dynamic pricing. Aviva provides comprehensive digital services backed by centuries of experience, and Legal & General offers market-leading expertise with unlimited coverage options. For those with specific health needs, The Exeter provides specialist underwriting, while HSBC delivers competitive pricing through banking integration.

The critical success factor lies in professional guidance through specialist brokers like WeCovr, who ensure you access the most suitable coverage from providers who view your specific risk profile most favourably. This expert approach can save hundreds of pounds annually while securing comprehensive protection tailored to your unique circumstances.

Key takeaways for successful life insurance planning:

- Start Early: Younger applicants enjoy lower premiums and easier underwriting

- Complete Honesty: Full disclosure ensures claims will be paid when needed

- Regular Reviews: Life changes require insurance adjustments

- Professional Guidance: Specialist brokers provide access to optimal solutions

- Quality Over Price: Focus on financial strength and claims performance alongside competitive pricing

With 98.3% of claims paid and premiums starting from £3.52 monthly, life insurance represents one of the most reliable and cost-effective financial protections available to UK families. The providers featured in this guide represent the finest the industry offers, each excelling in different areas while maintaining the exceptional standards UK consumers deserve.

Whether you require basic term cover, comprehensive critical illness protection, or specialist underwriting for health conditions, the UK market provides solutions for every need and budget. The key lies in matching your specific requirements with the provider best equipped to serve them, ensuring your family's financial security regardless of what the future holds.

This guide is based on publicly available information from insurer websites, regulatory filings, and independent rating agencies, accurate as of August 2025. Premium examples are indicative and subject to individual underwriting. Always obtain personal quotes and seek professional advice before making insurance decisions.

Related guides

Why life insurance and how does it work?

What is Life Insurance?

Life insurance is an insurance policy that can provide financial support for your loved ones when you or your joint policy holder passes away. It can help clear any outstanding debts, such as a mortgage, and cover your family's living and other expenses such costs of education, so your family can continue to pay bills and living expenses. In addition to life insurance, insurance providers offer related products such as income protection and critical illness, which we will touch upon below.How does it work?

Life insurance pays out if you die. The payout can be in the form of a lump sum payment or can be paid as a replacement for a regular income. It's your decision how much cover you'd like to take based on your financial resources and how much you'd like to leave to your family to help them deal with any outstanding debts and living expenses. Your premium depends on a number of factors, including your occupation, health and other criteria.The payout amount can change over time or can be fixed. A level term or whole of life policy offers a fixed payout. A decreasing term policy offers a payout that decreases over the term of the cover.

With critical illness policies, a payout is made if you’re diagnosed with a terminal illness with a remaining life expectancy of less than 12 months. While income protection policies ensure you can continue to meet your financial commitments if you are forced to take an extended break from work. If you can’t work because you’ve had an accident, fallen sick, or lost your job through no fault of your own, income protection insurance pays you an agreed portion of your salary each month.

Income protection is particularly helpful for people in dangerous occupations who want to be sure their mortgage will always be covered. Income protection only covers events beyond your control: you’re much less likely to be covered if you’re fired from your job or if you injure yourself deliberately.

Questions to ask yourself regarding life insurance

Just ask yourself:👉 Who would pay your mortgage or rent if you were to pass away or fall seriously ill?

👉 Who would pay for your family’s food, clothing, study fees or lifestyle?

👉 Who would provide for the costs of your funeral or clear your debts?

👉 Who would pay for your costs if you're unable to work due to serious illness or disability?

Many families don’t realise that life, income protection and critical illness insurance is one of the most effective ways to protect their finances. A great insurance policy can cover costs, protect a family from inheriting debts and even pay off a mortgage.

Many would think that the costs for all the benefits provided by life insurance, income protection insurance or critical illness insurance are too high, but the great news is in the current market policies are actually very inexpensive.

Benefits offered by income protection, life and critical illness insurance

Life insurance, income protection and critical illness insurance are indispensable for every family because a child loses a parent every 22 minutes in the UK, while every single day tragically 60 people suffer major injuries on the UK roads. Some people become unable to work because of sickness or disability.Life insurance cover pays out a lump sum to your family, loved ones or whomever you choose to get the money. This can be used to secure the financial future of your loved ones meaning they would not have to struggle financially in the event of your death.

If it's a critical illness cover, the payout happens sooner - upon diagnosis of a serious illness, disability or medical condition, easing the financial hardship such an event inevitably brings.

Income protection insurance can be very important for anyone who relies on a pay check to cover their living costs, but it's especially important if you’re self-employed or own a small business, where your employment and income is a bit less stable. It pays a regular income if you can't work because of sickness or disability and continues until you return to paid work or you retire.

In a world where 1 in 4 of us would struggle financially after just four weeks without work, the stark reality hits hard – a mere 7% of UK adults possess the vital shield of income protection. The urgency of safeguarding our financial well-being has never been more palpable.

Let's face it – relying on savings isn't a solution for everyone. Almost 25% of people have no savings at all, and a whopping 50% have £1,000 or less tucked away. Even more concerning, 51% of Brits – that's a huge 27 million people – wouldn't last more than one month living off their savings. That's a 10% increase from 2022.

And don't even think about state benefits being a safety net. The maximum you can expect from statutory sick pay is a mere £109.40 per week for up to 28 weeks. Not exactly a financial lifeline, right?

Now, let's tackle a common objection: "But I have critical illness insurance. I don't need income protection too." Here's the deal – the two policies apply to very different situations. In a nutshell:

- Critical illness insurance pays a single lump sum if you're diagnosed with or undergo surgery for a specified potentially life-threatening illness. It's great for handling big one-off expenses or debts.

- Income protection, on the other hand, pays a percentage of your salary as a regular payment if you can't work due to illness or injury. It's the superhero that tackles those relentless monthly bills.

Types of life insurance policies

Common reasons for getting a life insurance policy are to:✅ Leave behind an amount of money to keep your family comfortable

✅ Protect the family home and pay off the mortgage in full or in part

✅ Pay for funeral costs

Starting from as little as a couple of pounds per week, you can do all that with a Life Policy.

Level Term Life Insurance

One of the simplest forms of life insurance, level term life insurance works by selecting a length of time for which you would want to be covered and then deciding how much you would like your loved ones to receive should the worst happen. Should your life insurance policy pay out to your family, it would be in a lump sum amount that can be used in whatever way the beneficiary may wish.

Decreasing Term Life Insurance

Decreasing term life insurance works in the same way as level term, except the lump sum payment amount upon death decreases with time. The common use for decreasing term life cover is to protect against mortgage repayment as the lump sum decreases along with the principal of the mortgage itself.

Increasing Term Life Insurance

Increasing term life insurance aims to pay out a cash sum growing each year if the worst happens while covered by the policy. With increasing term life cover amount insured increases annually by a fixed amount for the length of the policy. This can protect your policy's value against inflation, which could be advantageous if you’re looking to maintain your loved ones’ living standards, continue paying off your mortgage in line with its repayment schedule and cover your children’s education fees.

Whole of Life Insurance

Whereas term life insurance policies only pay out if you pass away during their term, whole of life insurance pays out to your beneficiaries whenever this should happen. The most common uses for whole life insurance are to cover the costs of a funeral or as a vehicle for your family's inheritance tax planning.

Family Income Benefit

Family income benefit is a somewhat lesser-known product in the family of life insurance products. Paying out a set amount every month of year to your beneficiaries, it is the most cost-effective way of maintaining your family's living standards to an age where you'd expect them to be able to support themselves financially. The most common use would be for a family with children who are not working yet so are unable to take care of themselves financially.

Relevant Life Insurance

Relevant Life Insurance is a tax-efficient policy for a director or single employee. A simple level term life insurance product, it is placed in a specific trust to ensure its tax efficiency. The premiums are tax deductible and any benefit payable should a claim arise is also paid out tax free, which makes it an attractive product for entrepreneurs and their businesses.

Important Fact!

We can look at a more suitable option mid-term!

Why is it important to get life insurance early?

👉 Many people are very thankful that they had their life, income protection, and critical illness insurance cover in place before running into some serious issues. Critical illness and income protection insurance is as important as life insurance for protecting your family's finances.👉 We insure our cars, houses, bicycles and even bags! Yet our life and health are the most precious things we have.

Easily one of the most important insurance purchases an individual or family can make in their lifetime, the decision to buy life, income protection, critical illness and private medical health insurance can be made much simpler with the help of FCA-authorised advisers. They are the specialists who do the searching and analysis helping people choose between various types of life insurance policies available in the market, including income protection, critical illness and other types of policies most suitable to the client's individual circumstances.

It certainly won't do any harm if you speak with one of our experienced FCA-authorised insurance partner experts who are passionate about advising people on financial matters related to life insurance and are keen to provide you with a free consultation.

You can discuss with them in detail what affordable life, income protection, critical illness or private medical health insurance plan for the necessary peace of mind they would recommend! WeCovr works with some of the best advisers in the market.

By tapping the button below, you can book a free call with them in less than 30 seconds right now:

Our Group Is Proud To Have Issued 900,000+ Policies!

We've established collaboration agreements with leading insurance groups to create tailored coverage

How It Works

1. Complete a brief form

2. Our experts analyse your information and find you best quotes

3. Enjoy your protection!

Any questions?

Learn more

Who Are WeCovr?

WeCovr is an insurance specialist for people valuing their peace of mind and a great service.👍 WeCovr will help you get your private medical insurance, life insurance, critical illness insurance and others in no time thanks to our wonderful super-friendly experts ready to assist you every step of the way.

Just a quick and simple form and an easy conversation with one of our experts and your valuable insurance policy is in place for that needed peace of mind!