TL;DR

The UK private medical insurance landscape has experienced unprecedented transformation in 2025, with record numbers of Britons turning to private healthcare as NHS waiting lists continue to soar. With 8.06 million people now covered by private medical insurance - representing 11.8% of the UK population - choosing the right PMI provider has never been more critical. This comprehensive guide examines the top 10 private medical insurance providers in the UK, providing detailed analysis of their offerings, costs, and unique benefits.

Key takeaways

- Illustrative estimate: Individual coverage: £79.59

- Illustrative estimate: Couple coverage: £145.77

- Illustrative estimate: Family of four: £166.52

- Competitive pricing: Lower premiums while maintaining core benefits

- Essential coverage: Focus on fundamental PMI requirements

The Complete Guide to the UK's 10 Best Private Medical Insurance Providers: 2026 Edition

The UK private medical insurance landscape has experienced unprecedented transformation in 2025, with record numbers of Britons turning to private healthcare as NHS waiting lists continue to soar. With 8.06 million people now covered by private medical insurance - representing 11.8% of the UK population - choosing the right PMI provider has never been more critical.

This comprehensive guide examines the top 10 private medical insurance providers in the UK, providing detailed analysis of their offerings, costs, and unique benefits. Whether you're seeking comprehensive family coverage or budget-friendly individual protection, understanding the nuances of each provider will help you make an informed decision about your healthcare future.

The State of UK Private Medical Insurance in 2026

The private medical insurance market has reached a record valuation of £6.15 billion, growing by an impressive 12.2% year-on-year. This surge reflects fundamental shifts in how Britons approach healthcare, driven by:

- Record NHS waiting lists: 7.39 million people currently waiting for treatment

- Extended treatment delays: Over 2.98 million waiting more than 18 weeks

- Employer benefit expansion: 4.7 million people covered through workplace schemes

- Illustrative estimate: Increased claims activity: £3.57 billion paid out in PMI claims in 2023

Market Concentration and Competition

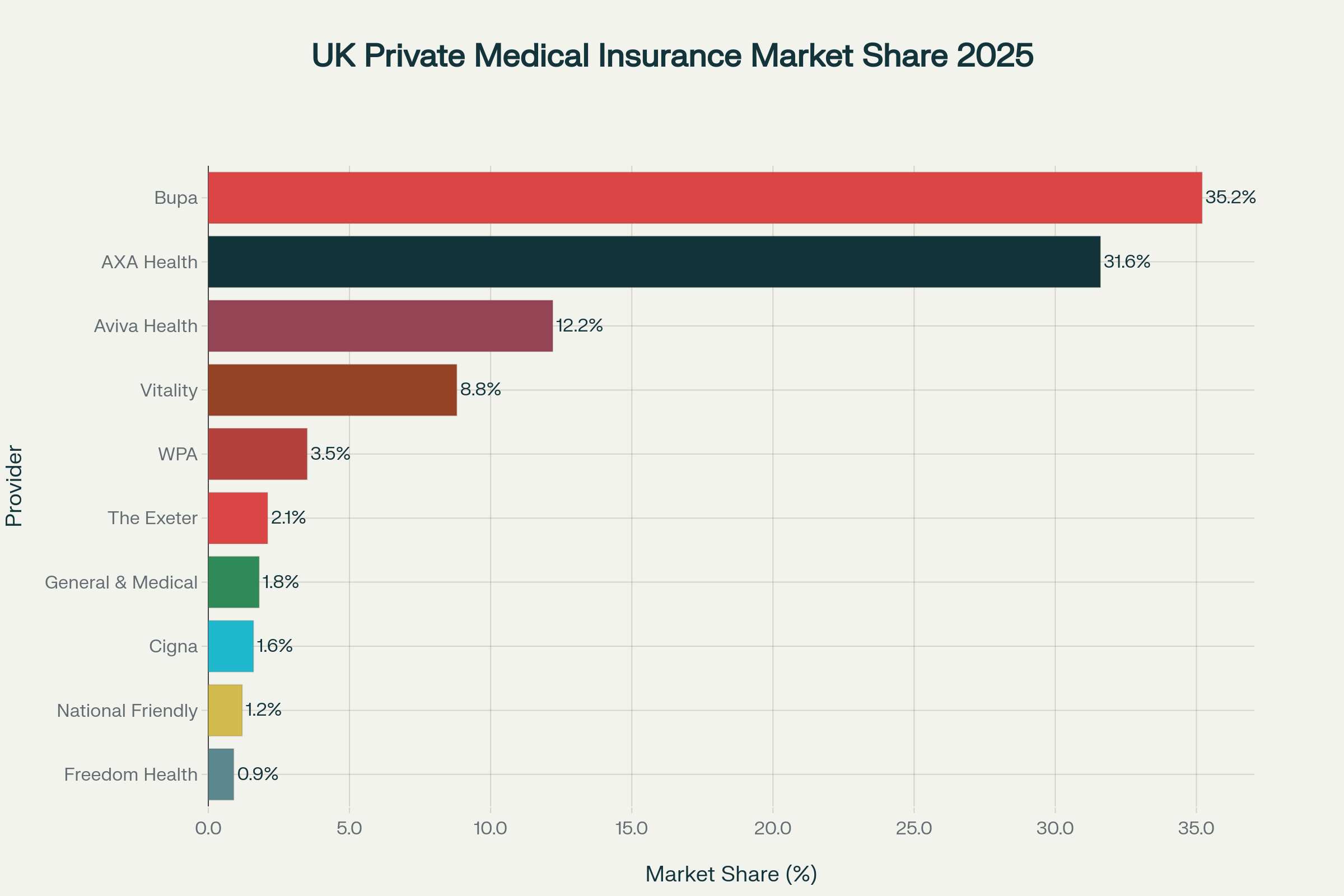

The UK PMI market demonstrates significant concentration among the "Big Four" providers - Bupa, AXA Health, Aviva, and Vitality - who collectively capture 95% of the market. This concentration has increased from 88.3% in 2017, indicating ongoing consolidation within the industry.

UK Private Medical Insurance market share showing the dominant position of Bupa and AXA Health in 2025

The chart above illustrates the dominant market positions of leading providers, with Bupa and AXA Health together controlling nearly 67% of the entire UK PMI market.

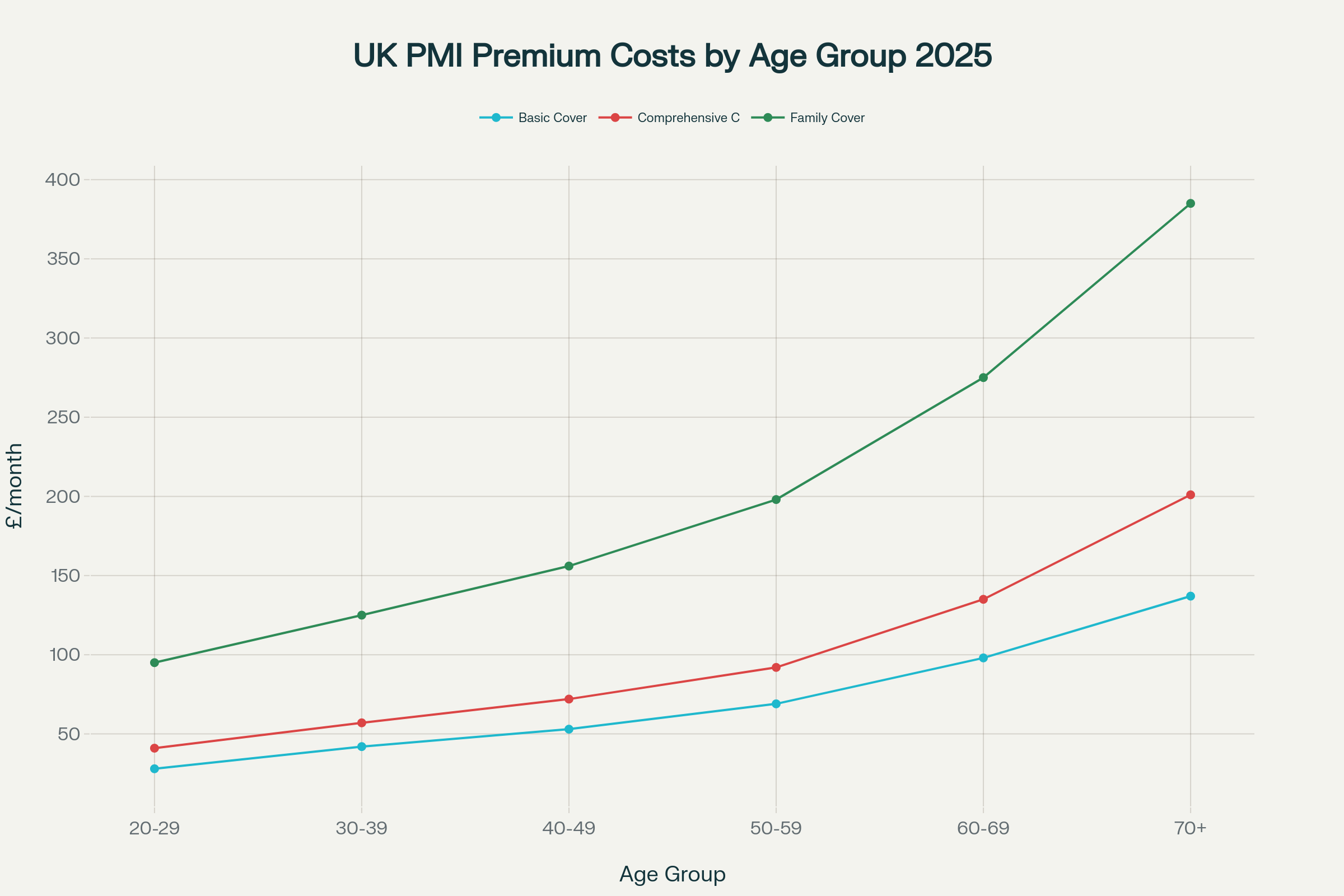

Understanding PMI Costs Across Age Groups

Private medical insurance premiums vary dramatically based on age, with older applicants paying up to five times more than younger policyholders. Understanding these cost structures is essential for long-term financial planning.

(illustrative estimate)

(illustrative estimate)

UK PMI premium costs increase significantly with age, with comprehensive family cover reaching £385/month for over-70s (illustrative estimate)

The age-related cost progression demonstrates why early PMI adoption can provide significant long-term value, particularly for family coverage where costs can exceed £385 monthly for households with older members. (illustrative estimate)

Average UK PMI Costs in 2026

Based on comprehensive analysis of over 12,000 quotes from leading providers, the average monthly PMI costs are :

- Illustrative estimate: Individual coverage: £79.59

- Illustrative estimate: Couple coverage: £145.77

- Illustrative estimate: Family of four: £166.52

These averages represent combined pricing for policies with and without outpatient coverage, reflecting the full spectrum of available options.

The Top 10 UK Private Medical Insurance Providers

1. Bupa: The Market Leader

Market Share: 35.2% | Customer Base: 2.3 million | Trustpilot Rating: 4.4/5

Bupa stands as the undisputed leader in UK private healthcare, serving over 43 million customers globally with 2.3 million health insurance customers in the UK. Founded in 1947 as the British United Provident Association, Bupa operates as a private company with no shareholders, reinvesting all profits into service improvements.

Key Strengths:

- Comprehensive cancer coverage: Direct access without GP referral for suspected cancer symptoms

- Extensive hospital network: Access to premium facilities nationwide

- Bupa Blua Health: Advanced digital GP service with video consultations

- International coverage: Seamless global healthcare through Bupa Global

Product Range:

- Bupa By You: Two-tier system offering Essential and Comprehensive coverage levels

- Illustrative estimate: Average monthly cost: £75.35 for individual comprehensive coverage

- No-claims discounts: Available with potential renewal impacts

Best For: Families seeking comprehensive coverage with access to leading specialists and hospitals. Particularly strong for cancer care and those prioritising extensive hospital choice.

Recent Performance: Added 433,000 new UK customers in the first half of 2024, demonstrating continued market confidence despite 16% revenue increase.

2. AXA Health: Innovation and Flexibility Leader

Market Share: 31.6% | Customer Base: 1.8 million | Trustpilot Rating: 4.1/5

AXA Health (formerly AXA PPP Healthcare) represents the modern face of private medical insurance, emphasising flexibility and mental health support. With 80 years of UK healthcare experience, AXA has evolved into a forward-thinking provider focusing on customisable coverage.

Key Strengths:

- Personal Health Plan: Highly modular policy structure allowing precise customisation

- Doctor@Hand: 24/7 digital GP consultations via smartphone app

- Mental health focus: Comprehensive psychological support without GP referral

- Guided consultant choice: Cost-effective specialist selection with clinical oversight

Product Features:

- Illustrative estimate: Outpatient options: Full cover, standard cover (£1,250 limit), or financial caps from £500-£1,500

- Therapies add-on: Separate allowances for physiotherapy and complementary treatments

- Cancer pathway: Direct access to oncology services

Best For: Individuals seeking tailored coverage with strong mental health support. Ideal for those comfortable with guided treatment pathways to reduce costs.

Specialist broker services like WeCovr can help optimise AXA Health policies, ensuring customers receive maximum value through expert customisation of their Personal Health Plan.

3. Aviva Health: The Reliable All-Rounder

Market Share: 12.2% | Customer Base: 1.2 million | Trustpilot Rating: 4.3/5

Aviva Health leverages its position as a household name in UK insurance to deliver consistently reliable private medical coverage. Their 'Healthier Solutions' policy strikes an excellent balance between comprehensive benefits and accessible pricing.

Key Strengths:

- Expert Select hospitals: Premium facility access at standard pricing

- Aviva Digital GP: Comprehensive telemedicine platform

- Illustrative estimate: Flexible outpatient options: From £1,000 caps to unlimited coverage

- Established trust: Backed by Aviva's centuries-old insurance expertise

Coverage Highlights:

- Core inpatient treatment: Unlimited day-patient and inpatient care

- Cancer support: Full diagnostic and treatment pathways

- Mental health options: Available as policy add-ons

- Therapies coverage: Physiotherapy and complementary treatment options

Best For: First-time PMI buyers seeking reliable coverage from a trusted brand. Excellent choice for those wanting straightforward policies without complex decision trees.

4. Vitality: The Wellness Revolution

Market Share: 8.8% | Customer Base: 1.9 million | Trustpilot Rating: 4.4/5

Vitality transformed the UK health insurance landscape with its revolutionary 'Shared Value' wellness model. As the UK's third-largest health insurer, Vitality incentivises healthy living through its unique Active Rewards programme.

Key Strengths:

- Active Rewards programme: Premium reductions up to 100% through healthy lifestyle tracking

- Vitality GP: Digital consultation platform integrated with wellness tracking

- Corporate wellness: Leading provider for business health insurance

- Innovative benefits: Discounts on gym memberships, healthy food, and wellness products

Unique Features:

- Vitality Age: Biological age assessment reducing premiums for healthy lifestyles

- Partners network: Extensive wellness partnerships including Apple, Garmin, and premium gyms

- Weight management: Recent addition of discounted weight-loss treatments (up to 20% off Wegovy and Mounjaro)

Financial Performance: Returned to profit growth with normalised profit of £40m in H1 2024, demonstrating sustainable business model.

Best For: Health-conscious individuals and families who will actively engage with wellness programmes. Particularly valuable for those already maintaining active lifestyles or motivated by rewards.

5. The Exeter: Specialist Care for Complex Cases

Market Share: 2.1% | Customer Base: 0.15 million | Trustpilot Rating: 4.0/5

The Exeter operates as a mutual insurer owned by its members, specialising in personalised approaches to private medical insurance. Their reputation for flexible underwriting makes them particularly valuable for older applicants and those with medical history.

Key Strengths:

- Health+ policies: Choice between Traditional and Guided coverage options

- Illustrative estimate: Market-leading no-claims discount: Claims under £300 don't impact renewal premiums

- Targeted underwriting: Fewer exclusions through personalised assessment

- Member ownership: Mutual structure prioritises member interests over shareholder profits

Product Structure:

- Health+ Traditional: Full choice of consultants and hospitals

- Health+ Guided: Reduced costs through managed treatment pathways

- Illustrative estimate: Flexible pricing: Starting from under £32 monthly for essential coverage

Coverage by Age:

- Illustrative estimate: 30-year-old: £41.50-£77.10 monthly depending on hospital list

- Illustrative estimate: 50-year-old: £69.00-£123.50 monthly

- 60-year-old: £98.00-£179.20 monthly

Best For: Individuals over 65 or those with pre-existing conditions who may struggle to obtain coverage elsewhere. Excellent for those seeking personalised underwriting approaches.

6. WPA: The Only Which? Recommended Provider

Market Share: 3.5% | Customer Base: 0.4 million | Trustpilot Rating: 4.6/5

Western Provident Association (WPA) holds the distinction of being the only Which? Recommended Provider of Private Medical Insurance for both 2023 and 2024. This not-for-profit insurer, founded in 1901, specialises exclusively in health insurance.

Key Strengths:

- Which? Recognition: Only provider achieving Recommended Provider status with 76% customer satisfaction score

- Shared Responsibility options: Co-payment arrangements reducing premiums significantly

- Not-for-profit structure: 120+ years of member-focused service

- Discretionary benefits: Flexible approach to claims assessment

Unique Features:

- Customer satisfaction leadership: 83% claims satisfaction score, highest in industry

- Stable customer base: 87% renewal rate, approximately 5% above market average

- Specialisation focus: Health insurance only, no distractions from other insurance products

Customer Feedback: Which? customers praised WPA for "speed of claims, choice of consultants available" and "clarity of terms and conditions".

Best For: Customers seeking proven service excellence backed by independent recognition. Ideal for those comfortable with co-payment structures to reduce premium costs.

7. Cigna: The International Specialist

Market Share: Growing UK presence | Trustpilot Rating: 4.1/5

Cigna is a leading global private medical insurer, offering UK customers specialist international health policies that cover treatment both domestically and abroad.

Key Strengths:

- Extensive international hospital network

- Flexible global coverage ideal for expatriates and frequent travellers

- Comprehensive inpatient and outpatient options

- Strong mental health and wellness inclusions

Best For: Expatriates, international travellers, and those needing cross-border healthcare access.

Specialist brokers like WeCovr can arrange tailored PMI policies with Cigna, ensuring seamless access to private healthcare in the UK and internationally.

8. General & Medical: The Corporate Specialist

Market Share: 1.8% | Customer Base: 0.12 million | Trustpilot Rating: 4.4/5

General & Medical Healthcare offers comprehensive private medical insurance solutions with particular strength in corporate and group schemes. Established in 1904, they provide traditional PMI policies with clear benefit structures.

Key Strengths:

- Wide policy range: From basic to elite coverage levels

- Group scheme expertise: Specialised corporate healthcare solutions

- Clear benefit structures: Traditional approach to policy design

- Established heritage: Over 120 years of insurance experience

Coverage Options:

- Individual policies: Comprehensive range from essential to premium

- Family coverage: Scalable solutions for household protection

- Corporate schemes: Tailored business healthcare programmes

Best For: Businesses seeking group health insurance schemes and individuals preferring traditional policy structures with clearly defined benefits.

9. Freedom Health: Budget-Friendly Comprehensive Coverage

Market Share: 0.9% | Customer Base: 0.08 million | Trustpilot Rating: 4.3/5

Freedom Health Insurance positions itself as a budget-conscious option while maintaining comprehensive coverage levels. Founded in 2000, they focus on providing essential private medical insurance without premium pricing.

Key Features:

- Competitive pricing: Lower premiums while maintaining core benefits

- Essential coverage: Focus on fundamental PMI requirements

- Straightforward policies: Simplified policy structures

- Modern approach: Digital-first customer service

Target Market: Young professionals and price-sensitive individuals seeking comprehensive private medical protection without premium costs.

Best For: First-time PMI buyers and younger individuals prioritising cost-effectiveness while maintaining adequate coverage levels.

10. National Friendly: Essential Inpatient Focus

Market Share: 1.2% | Customer Base: 0.1 million | Trustpilot Rating: 4.4/5

National Friendly provides essential inpatient coverage for individuals seeking basic private medical protection. Established in 1922, they focus on core inpatient procedures without extensive optional extras.

Key Approach:

- Inpatient specialisation: Focused coverage for major procedures

- Budget-friendly: Accessible pricing for essential coverage

- Simplified policies: Straightforward benefit structures

- Long-term stability: Nearly 100 years of operation

Best For: Individuals seeking basic safety net coverage for major inpatient procedures, particularly those on strict budgets who want fundamental private medical protection.

Detailed Provider Comparison Analysis

The comprehensive comparison data reveals significant variations in market positioning, with each provider targeting distinct customer segments through specialised approaches to coverage and pricing.

Choosing the Right PMI Provider: Expert Guidance

Key Selection Criteria

Coverage Requirements:

- Inpatient vs. outpatient needs: Determine whether you need comprehensive outpatient coverage or basic inpatient protection

- Specialist access: Consider whether you prefer choosing your own consultants or accept guided options for cost savings

- Geographic coverage: Evaluate hospital network access in your preferred locations

Financial Considerations:

- Premium affordability: Balance monthly costs against potential claim benefits

- Excess levels: Higher excess amounts reduce premiums but increase out-of-pocket costs

- Long-term cost projection: Consider how age-related premium increases affect long-term affordability

Service Preferences:

- Digital services: Evaluate the quality and availability of telemedicine platforms

- Customer service: Review satisfaction ratings and claims handling reputation

- Additional benefits: Consider wellness programmes, mental health support, and complementary therapies

The Value of Professional PMI Brokers

Navigating the complex PMI landscape often requires expert guidance. Specialist brokers like WeCovr provide invaluable services including:

- Whole-market comparison: Access to all major providers with unbiased recommendations

- Policy customisation: Expert assistance in tailoring coverage to individual needs

- Cost optimisation: Professional negotiation potentially saving up to 38% on premiums

- Ongoing support: Assistance throughout policy lifecycle including claims support and annual reviews

Professional brokers understand the nuances of each provider's underwriting approach, enabling them to match applicants with the most suitable insurers based on individual circumstances, health history, and coverage requirements.

Market Trends and Future Outlook

Digital Healthcare Integration

The PMI market continues embracing digital transformation:

- Telemedicine expansion: All major providers now offer digital GP consultations

- AI diagnostics: Advanced technology improving treatment pathway efficiency

- Wellness integration: Increased focus on preventive care through digital platforms

- Mobile-first services: Enhanced customer experience through smartphone applications

Regulatory Environment

Evolving standards are reshaping the market:

- Transparency requirements: Increased pricing disclosure obligations

- Consumer protection: Enhanced rights for policyholders

- Clinical governance: Stricter quality standards for covered treatments

- Data protection: Robust privacy safeguards for health information

Demographic Shifts

Changing customer profiles are influencing product development:

- Younger adoption: Average new policyholder age decreasing to late 30s

- Corporate expansion: Growing employer-provided coverage schemes

- Family focus: Increased emphasis on family-friendly policy structures

- Mental health priority: Greater demand for psychological support services

Regional Cost Variations and Provider Access

London Premium Pricing

London commands the highest PMI costs in the UK, with premiums averaging 22.9% above the national average. Specific London boroughs show even greater variations:

- Chiswick: 30.18% above national average (highest in UK)

- Central London: 25-28% premium over national rates

- South London: 15-20% above average

Most Affordable Regions

Cost-conscious consumers benefit from regional variations:

- Newcastle upon Tyne: 16.6% below national average

- North East England: 14.9% below national average

- Northern Ireland: Consistently lower across all specialties

- Scotland: Generally 8-12% below English averages

Provider Network Coverage

Geographic coverage varies significantly between providers:

- Bupa: Most extensive network with premium London facilities

- AXA Health: Strong urban coverage with guided options for cost management

- Aviva: Balanced national network with Expert Select facilities

- Vitality: Comprehensive coverage with wellness partner integration

Understanding Policy Terms and Coverage Limitations

Standard Exclusions

All UK PMI policies share fundamental limitations:

- Pre-existing conditions: Not covered under standard policies

- Chronic condition management: Routine care for ongoing conditions excluded

- Cosmetic procedures: Non-medical aesthetic treatments not covered

- Accident & Emergency: NHS provides emergency care, not PMI

Coverage Variations

Outpatient coverage represents the primary differentiation:

- Full outpatient: Unlimited consultations, diagnostics, and minor procedures

- Illustrative estimate: Limited outpatient: Annual caps from £500-£2,000

- Inpatient only: Hospital treatments without consultation coverage

- Guided pathways: Managed treatment routes for cost control

Waiting Periods and Restrictions

Understanding policy conditions prevents claim disappointments:

- Initial waiting periods: Typically 3-6 months for certain conditions

- Moratorium underwriting: Pre-existing conditions excluded for initial period

- Treatment limitations: Some procedures require prior authorisation

- Geographic restrictions: Coverage may be limited to UK facilities

Cost Management Strategies for PMI

Premium Optimisation Techniques

Reducing PMI costs without compromising essential coverage:

Higher Excess Options:

- Illustrative estimate: £250 excess: Standard option balancing cost and affordability

- Illustrative estimate: £500-£1,000: Significant premium reductions for those able to self-fund initial costs

- Illustrative estimate: £3,000-£5,000: Substantial savings for high-net-worth individuals (offered by The Exeter)

Coverage Customisation:

- Outpatient limitations: Removing or capping outpatient coverage reduces premiums by approximately 40-50%

- Hospital list restrictions: Accepting limited facility access saves 15-25% on premiums

- Guided consultant options: Provider-managed specialist selection offers 20% typical savings

No-Claims Benefits:

- Standard discounts: Most providers offer 5-15% reductions for claim-free years

- Illustrative estimate: The Exeter advantage: Market-leading approach where claims under £300 don't affect renewals

- Protected no-claims: Available for additional premium to maintain discounts despite claims

Long-term Financial Planning

Sustainable PMI strategies require forward planning:

Age-related Cost Projection:

- 20s-30s: Establish coverage early for long-term cost management

- 40s-50s: Peak earning years ideal for comprehensive coverage investment

- 60s+: Focus on essential coverage with realistic budget allocation

Family Coverage Evolution:

- Young families: Prioritise children's coverage with basic adult protection

- Teenagers: Transition to individual policies before university age

- Empty nesters: Refocus coverage on age-appropriate healthcare needs

Claims Process and Customer Experience

Typical Claims Journey

Understanding the claims process enhances PMI value:

Step 1: Initial Assessment

- Contact your chosen provider's claims team

- Provide GP referral letter or medical documentation

- Receive pre-authorisation for proposed treatment

Step 2: Treatment Selection

- Choose from approved hospital and consultant networks

- Confirm coverage levels and any patient contributions

- Schedule treatment through provider or direct booking

Step 3: Treatment Delivery

- Receive private healthcare as per policy terms

- Provider handles payment directly with healthcare facility

- Patient pays any applicable excess or co-payment amounts

Step 4: Post-Treatment Support

- Follow-up care as covered by policy terms

- Additional treatment authorisation if required

- Ongoing relationship management with provider

Customer Satisfaction Metrics

Provider performance varies significantly across service dimensions:

Claims Handling Excellence:

- WPA: 83% claims satisfaction (industry leading)

- Bupa: Strong performance across cancer care pathways

- Vitality: Excellent digital integration for claims management

- The Exeter: Personalised approach to complex cases

Customer Service Quality:

- WPA: Only Which? Recommended Provider status

- Aviva: Consistent all-round performance

- AXA Health: Strong digital-first customer experience

Specialist Treatment Areas and Provider Excellence

Cancer Care Leadership

Cancer treatment represents PMI's most critical coverage area:

Bupa Excellence:

- Direct access to cancer specialists without GP referral

- Comprehensive treatment pathways from diagnosis through recovery

- Access to latest treatments and clinical trials

- Specialist cancer centres nationwide

AXA Health Innovation:

- Guided cancer pathways ensuring optimal treatment routes

- Mental health support integrated with cancer care

- Digital monitoring and support through treatment journey

Mental Health Support Evolution

Mental health coverage has become a key differentiator:

Comprehensive Providers:

- AXA Health: Mental health as core policy component, not add-on

- Vitality: Wellness-integrated psychological support

- Aviva: Flexible mental health options through policy additions

Access Models:

- Direct access: No GP referral required (AXA Health, Bupa)

- Integrated support: Combined with physical health pathways

- Digital-first: App-based therapy and counselling options

Specialty Care Networks

Provider networks vary significantly by medical specialty:

Orthopaedic Excellence:

- Bupa: Access to leading joint replacement specialists

- The Exeter: Personalised approach to complex orthopaedic cases

- Aviva: Expert Select hospitals for premium orthopaedic care

Cardiovascular Specialisation:

- Premium cardiac centres accessible through major providers

- Direct access to leading cardiologists and cardiac surgeons

- Comprehensive diagnostic and treatment pathways

Technology Integration and Digital Health Services

Digital GP Platforms Comparison

Each provider offers distinct digital healthcare approaches:

Bupa Blua Health:

- Video consultations with experienced GPs

- Integration with wider Bupa healthcare network

- Prescription services and specialist referrals

- 24/7 availability for urgent consultations

AXA Doctor@Hand:

- Smartphone app-based consultations

- Immediate access to UK-registered GPs

- Mental health crisis support available

- Sick notes and prescription services

Vitality GP:

- Integrated with Active Rewards wellness programme

- Health tracking data incorporated into consultations

- Preventive care focus aligned with wellness model

- Specialist referral pathways optimised for member health

Wellness Programme Integration

Technology-enabled wellness represents the future of PMI:

Vitality Leadership:

- Comprehensive activity tracking through multiple devices

- Rewards programme reducing premiums up to 100%

- Partner network including Apple, Garmin, and fitness providers

- Behavioural science approach to health improvement

Emerging Trends:

- AI-powered health assessments: Personalised risk evaluation

- Wearable device integration: Continuous health monitoring

- Predictive healthcare: Early intervention based on data analysis

- Telemedicine expansion: Reduced need for physical consultations

Making Your Final Decision: A Strategic Approach

Selecting the optimal PMI provider requires systematic evaluation of your specific circumstances, priorities, and long-term healthcare needs. The specialist brokers at WeCovr can provide invaluable guidance through this complex decision-making process.

Decision Framework

Personal Healthcare Assessment:

- Current health status: Evaluate existing conditions and family medical history

- Risk tolerance: Consider your comfort with waiting periods and treatment uncertainty

- Budget allocation: Determine sustainable monthly premium levels

- Coverage priorities: Identify essential vs. desirable coverage elements

Provider Suitability Matching:

- Service quality: Prioritise customer satisfaction and claims handling reputation

- Network access: Ensure adequate hospital and specialist availability

- Innovation alignment: Consider importance of digital services and wellness programmes

- Long-term stability: Evaluate provider financial strength and market position

Professional Guidance Integration:

- Expert consultation: Engage specialist PMI brokers for market insight

- Customisation support: Optimise policy structure for individual needs

- Ongoing management: Establish relationship for annual reviews and adjustments

- Claims support: Ensure professional assistance throughout treatment journey

Conclusion: Investing in Your Healthcare Future

The UK private medical insurance landscape in 2025 presents unprecedented opportunities for individuals and families seeking quality healthcare protection. With 8.06 million people now covered by PMI and the market valued at £6.15 billion, private healthcare has evolved from luxury to necessity for many Britons. (illustrative estimate)

Key insights for PMI decision-making:

Provider Diversity Offers Options: From Bupa's comprehensive market leadership to WPA's affordable coverage, each provider targets specific needs and budgets. Understanding these differences enables optimal selection.

Age and Location Drive Costs: PMI premiums increase significantly with age and vary substantially by location. Early adoption and regional awareness can generate substantial long-term savings.

Technology Integration Enhances Value: Digital GP services, wellness programmes, and telemedicine platforms add significant value beyond traditional insurance benefits.

Professional Guidance Optimises Outcomes: Specialist PMI brokers like WeCovr provide market expertise, cost optimisation, and ongoing support that can save both money and ensure appropriate coverage.

The choice between providers ultimately depends on individual circumstances, priorities, and long-term healthcare objectives. Whether prioritising Bupa's comprehensive coverage, AXA Health's flexibility, Vitality's wellness focus, or The Exeter's specialist care, the key lies in matching provider strengths to personal needs.

Professional consultation with specialist brokers ensures optimal provider selection, policy customisation, and long-term value maximisation. With NHS challenges likely to persist and private healthcare costs continuing to rise, securing appropriate PMI coverage through expert guidance represents a valuable investment in your health and peace of mind.

The UK's leading PMI providers offer world-class healthcare access, but navigating their complex offerings requires expertise. Partner with professionals who understand the market intricacies and can guide you to the optimal coverage for your unique circumstances.

For expert guidance on selecting the optimal PMI provider and customising coverage to your specific needs, specialist brokers like WeCovr offer comprehensive market analysis and ongoing support to ensure you receive maximum value from your private medical insurance investment.

Sources

- NHS England: Waiting times and referral-to-treatment statistics.

- Office for National Statistics (ONS): Health, mortality, and workforce data.

- NICE: Clinical guidance and technology appraisals.

- Care Quality Commission (CQC): Provider quality and inspection reports.

- UK Health Security Agency (UKHSA): Public health surveillance reports.

- Association of British Insurers (ABI): Health and protection market publications.